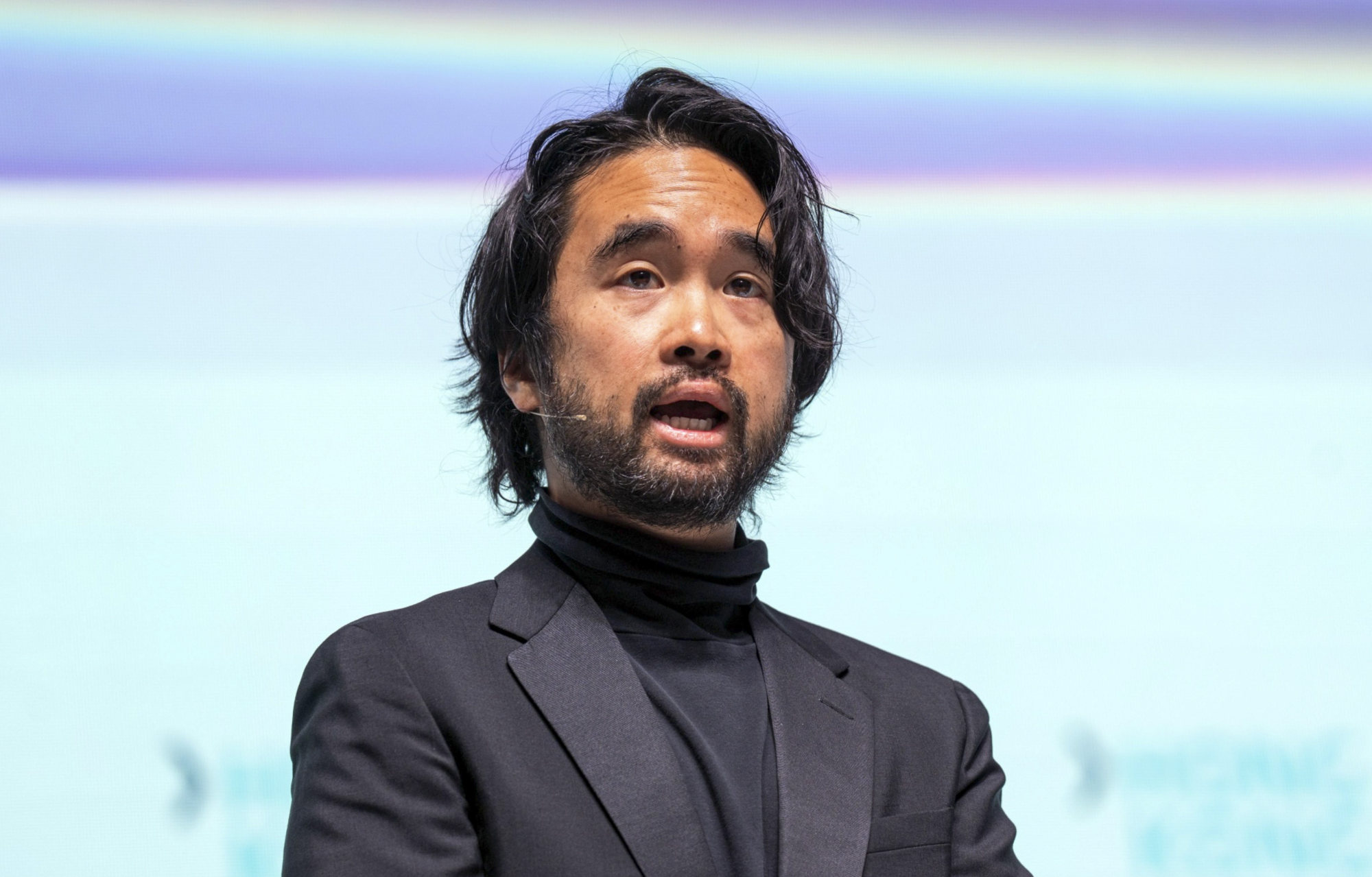

New World boss Adrian Cheng joins chorus asking Hong Kong officials to aid stagnant sector by easing cooling measures

[ad_1]

Profit attributable to shareholders came in at HK$901 million (US$115 million) from HK$1.25 billion a year earlier, while net profit declined 5 per cent to HK$4.08 billion, compared with HK$4.3 billion a year earlier. Revenue generated from property sales increased about 57 per cent year on year, with contracted sales in Hong Kong landing at HK$8.86 billion.

“I agree that the current property market situation is completely different from the time when these measures were introduced,” said Cheng, who is also New World’s executive vice-chairman.

Cheng said he hopes that the government will ease the curbs in phases, and in response to changes in the market environment, as a relaxation would unleash the public’s purchasing power, boosting economic development and improving the social atmosphere.

The company cut its final dividend by 80 per cent to HK$0.30 per share, compared with HK$1.50 previously. The reduction aims to retain cash for the company’s plan to repurchase bonds. Together with an interim dividend of HK$0.46 per share, the full-year dividend amounts to HK$0.76, compared with HK$2.01 a year earlier.

“When market conditions encounter challenges, especially in a sustained high interest rate environment, we need to retain cash and strength,” Cheng said, emphasising that this is a one-off dividend reduction. “When the general environment improves and local profits continue to rise, the dividend level will stabilise,” he said.

New World, controlled by one of Hong Kong’s richest families, will launch six new project phases next year, providing around 3,000 units. As of June 30, it had a total of 1,681 residential units available for sale in Hong Kong.

Developers set to delay flat sales until government eases cooling measures

Developers set to delay flat sales until government eases cooling measures

Hong Kong’s housing market remains mired in a slump, as multiple headwinds, including the economic outlook, elevated interest rates and a glut of new flats, continue to weigh on buyer sentiment.

Lived-in home prices in August fell 1.4 per cent month on month, the fourth straight month of decline, according to government data released on Wednesday.

[ad_2]

Source link