Qatar’s property market offers strong value now: Commercial Bank Group CEO

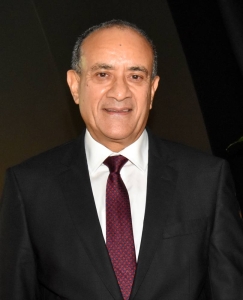

Commercial Bank Group CEO Joseph Abraham. PICTURE: Thajudheen

“Qatar’s real estate prices, given the quality, location, and finishing standards, offer exceptional value. When compared to markets like Dubai, Saudi Arabia, and other global hubs, property prices in Qatar remain reasonable. This means investors are truly getting value for their money,” Abraham said in an interview with Gulf Times.

Abraham noted that Qatar’s residential market has undergone a “significant correction” over the past six years.

“There is more upside than downside. The outlook is more positive than negative, with the commercial segment also experiencing corrections. We anticipate the market to stabilise at current levels in the near term.”

Regarding residential properties, Abraham remarked, “The sector’s growth potential will be driven by demand. While there are currently active buyers in the market, the expected government initiatives will stimulate a substantial uptick in activity. The government is taking the right steps, and all the necessary elements are in place, giving me reason to be optimistic.”

He highlighted that Dubai, a neighbouring real estate hotspot, attracted approximately $100bn in real estate investments last year, following the issuance of 158,000 Golden Visas.

Abraham dismissed concerns about a potential real estate bubble in Qatar, stating, “There is no bubble. A bubble is reflected in surging prices, demand exceeding supply and flipping of properties before completion. None of those factors are present in the Qatar real estate market. The market saw a surge in demand leading up to the FIFA World Cup Qatar 2022, particularly between 2013 and 2016. Since then, prices have adjusted significantly, eliminating any potential of a bubble.”

On the real estate exposure of local banks, Abraham said, “Qatar’s banking sector has around 16% exposure to real estate, which aligns with international standards. While the composition may differ — with individual mortgages being more prevalent internationally and commercial funding largely sourced from institutional investors such as pension funds and private equity — the overall exposure is consistent for the banking sector.”

On the potential impact of global interest rate trends, Abraham commented, “A decrease in interest rates, spurred by revisions from the US Federal Reserve (Fed), could serve as a catalyst for the real estate market. Lower rates would reduce debt service ratios, making home-ownership more accessible and attractive to a broader range of people.”

He further explained, “Monthly expenses are a key factor in consumers’ decision-making process, especially for significant purchases. Interest rates directly influence these outflows, particularly in the early years of a mortgage. This makes interest rates a critical factor for the real estate sector, not just in Qatar, but globally.”

Speaking about Commercial Bank’s mortgage portfolio, Abraham noted, “We were the first bank to collaborate with the UDC and promote Qatar’s real estate offerings to non-residents in some 10 key international markets including Singapore, Hong Kong, France, United Kingdom, India, Saudi Arabia and the UAE, encouraging foreign buyers to invest in Qatar property. Our mortgage solutions cater to non-residents, residents, and nationals, including young Qataris. We even offer green mortgages to support sustainable building initiatives, reflecting our commitment to a sustainable and diversified mortgage portfolio.”

When asked about customer response, Abraham acknowledged, “Building international market awareness of the attractiveness of the Qatar real estate market takes time, but we have already seen significant interest from both non-residents and long term residents. Educating the market, offering the right products, and effective marketing are all essential components of our strategy.”