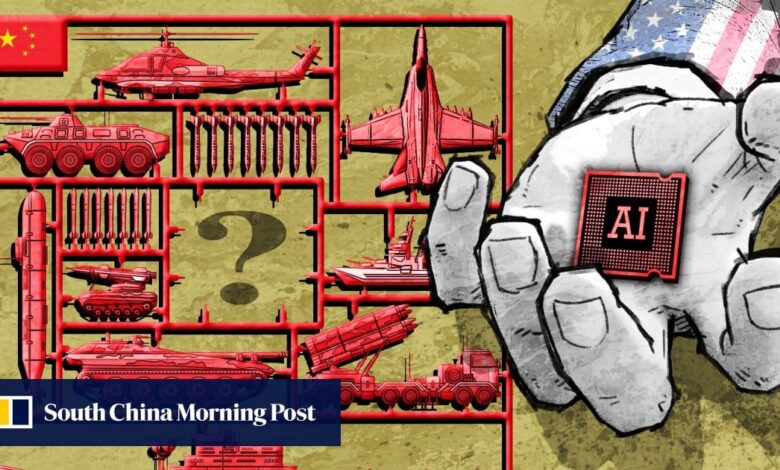

China’s march to military modernisation still has barriers to overcome: from US tech curbs to Beijing’s own distrust of private sector

[ad_1]

China is working on a new combat drone to pair with its J-20 stealth fighter

China is working on a new combat drone to pair with its J-20 stealth fighter

Finally, Washington finalised the rules concerning the Chips and Science Act last month to ensure that companies which receive US$39 billion worth of semiconductor manufacturing subsidies do not end up benefiting China and other countries deemed a threat to US national security.

Timothy Heath, a senior international defence researcher at the think tank Rand Corporation, said the semiconductor curbs would undermine Chinese efforts to catch up with the US.

“China will have to adapt by incorporating the chips that it has available. The result could be an increase in the gap between the quality and sophistication of US weapons and equipment compared to China,” said Heath.

“China’s inability to access advanced chips may affect PLA readiness to fight US forces … The PLA may become less confident as the technology gap increases.”

Heath said while China has successfully incorporated Western technology into its military, the sanctions will restrict private firms’ access to advanced technology in the US.

“China has successfully incorporated technologies including microelectronics, global positioning, navigation, metallurgy and computing [into its military],” he said.

“These technologies are highly significant for all kinds of weapons and equipment on the modern battlefield, as they increase the lethality and accuracy of weapons.

“China’s MCF [military-civil fusion] programme suffers from the fact that it mostly depends on Chinese technology since US restrictions and deepening Chinese tensions with US allies and partners has resulted in restricted access to the most advanced technologies. Thus, China will continue to suffer disadvantages in its MCF programme.”

He added: “The US-China trade war will continue to hamper the PLA’s development of advanced technologies and probably result in a slower pace of innovation in Chinese defence technologies.”

Western sanctions on Russian arms companies imposed in the wake of Moscow’s invasion of Ukraine last year could prove a further headache for China, which was the world’s fifth largest importer of weapons last year.

About 83 per cent of China’s imported weapons between 2018-2022 came from Russia, mostly consisting of helicopters and aircraft engines, according to the Stockholm International Peace Research Institute.

The PLA is working to modernise its fleet of warplanes, spending at least 900 billion yuan over the past decade, and is expected to step up the production and commission of its most advanced fighters, including the multirole J-16 and the J-20 stealth fighter this year.

PLA’s latest drills near Taiwan could signal surprise attack strategy: analysts

PLA’s latest drills near Taiwan could signal surprise attack strategy: analysts

“In the field of … fighter engines, [it is] difficult to master technologies that few countries have succeeded in,” said Heath. “China is still learning to master these technologies and thus will likely continue to study and try to learn from Russia.”

Kostas Tigkos, head of mission systems and intelligence at a global military intelligence company Janes, said sanctions on Russia would have an impact on China’s defence supply chains despite its efforts to develop its own technology and equipment.

“[China] still appears to rely on some components from Russia and therefore there might be some delays in deliveries or they might not be able to get as much as they had before,” said Tigkos.

“They managed to engineer certain solutions, maybe engines or even complete aircraft, to a degree that they can still produce them with a local capability and support them. But it might not be as efficient or it might have short-term failures. So they’re still ironing out their processes.”

China has an extensive defence industry and seven firms – all state-owned enterprises – ranked among the top 20 global arms suppliers in 2021, according to a report from the Stockholm International Peace Research Institute.

“In almost every sector we have seen developments in its arms industry and growth in arms sales. The shipbuilders, the aerospace and missile sector, the land systems, and IT. The modernisation is not targeting a specific sector but the entire military,” said Nan Tian, a senior researcher at the institute.

But the role of the private sector, which is seen as a key driver of innovation in the US defence industry, is far more limited.

A report by the China Aerospace Studies Institute at the US military’s Air University found that only 2 per cent of China’s 150,000 private hi-tech firms formed part of the defence supply chain in 2019.

Tian said military-civil fusion is still centred around state-owned firms that operate in both the civilian and military sectors, and government intervention has limited private companies’ involvement.

“Both the US and China look to draw private, civil companies into the military structure,” he said. “But in the case of the US, there are laws and regulations that limit state interference and protect the private company. This is much less clear in China. The CCP [Chinese Communist Party] has increasingly intruded into private technology companies.”

The US accounts for 40 per cent of global arms exports and Tigkos said the US is a leader in the sector because of substantial investment and a large market that attracts private companies.

“It’s innovation. It’s changing in thinking [that] is also developing new capabilities, driving the adoption of new technologies into different applications, and therefore delivering value [to the Pentagon],” said Tigkos.

In the meantime, the United States is investing heavily in new technology in the hope of staying ahead of China. The US defence department is investing US$9 billion in its Joint Warfighting Cloud Capability project, with contractors that include some of the country’s leading tech firms such as Google, Amazon, Microsoft and Oracle.

James Lewis, a senior vice-president and director of the strategic technologies programme at the Washington-based think tank Centre for Strategic and International Studies, warned increasing pressure from the government could undermine the ability to develop new technologies.

PLA likely building new giant warship amid speculation around online image

PLA likely building new giant warship amid speculation around online image

“China’s innovation ecosystem suffers from a tightening political space and bad investment decisions by the government, and the overall effect is to slow innovation,” said Lewis.

“China can be innovative, but that flourishing of innovation occurred in a period of relative political openness. Now that the period of opening was ending, would it also mean the end of Chinese innovation? The general consensus was yes.”

[ad_2]

Source link