‘Now or never’: the European drive to head off influx of cheaper Chinese electric cars

[ad_1]

“It is now or never,” said Johan Lindahl, secretary general at the European Solar Manufacturing Council (ESMC). “If investors don’t see that Europe is willing to support an industry that is under attack by China, there will be no investments at all at scale.”

At 3.7 per cent, these sales still account for a small share of the EU market, but are rising fast. Imports from China jumped 113 per cent in the first nine months of 2023 compared to a year earlier, while they have soared 78,000 per cent since 2019.

The investigation was informally requested by French carmakers and the French government, who are not very exposed to the Chinese sector. But the move had a mixed reception among industry groups, reflecting internal political complexities.

The German Association of the Automotive Industry (VDA) urged the EU to consider “possible reactions from China” during its investigation, amid fears that Beijing might retaliate against companies that are reliant on the Chinese market.

Iconic German car brands such as Volkswagen, Mercedes-Benz and BMW are all heavily involved in China’s EV sector, in some cases deepening ties with their Chinese joint venture partners to produce electric cars for export to Europe.

By contrast, the Brussels-based European Automobile Manufacturers’ Association, welcomed the move.

“China’s apparent advantage and cost-competitive imports are already impacting European automakers’ domestic market share, with a massive surge in electric vehicle imports in recent years,” director general Sigrid de Vries said.

That challenge was laid bare in a study published this week by the Centre for Strategic and International Studies, a Washington think tank. While the EU ran a monthly car trade surplus with China of €2.2 billion (US$2.3 billion) between 2019 and 2021, that became a deficit for the first time in December 2022.

A small surplus returned in the first quarter of this year, but the report said that “unless local production of EVs increases significantly or the European Union makes use of trade defence instruments, it is likely that imports from China will continue to rise, and by 2024 the European Union will experience a constant auto trade deficit with China”.

How China and its tech giants will transform the world’s biggest EV market

How China and its tech giants will transform the world’s biggest EV market

The driving force behind this shift is electric vehicles. A 27.5 per cent tariff has priced Chinese EVs out of the US market, but there are no such barriers in Europe.

“The majority of made-in-China EVs are exported to Europe due to the region’s high demand, low import tariffs, and substantial government subsidies for EVs regardless of origin,” the CSIS report said.

“In contrast to the United States, the EU has remained relatively open to Chinese greenfield investment and EV exports, so it faces somewhat different challenges.”

An EU official, speaking on condition of anonymity, warned that German carmakers needed to be “saved from themselves”, because their executives were obsessing over quarterly earnings rather than taking a responsible long-term view.

An industry executive, meanwhile, pointed to a call last month from the founder and chairman of Chinese EV giant BYD, Wang Chuanfu, for China’s carmakers to “demolish the old legends and achieve new world-class brands” as evidence that Beijing is systematically working to dismantle the European industry.

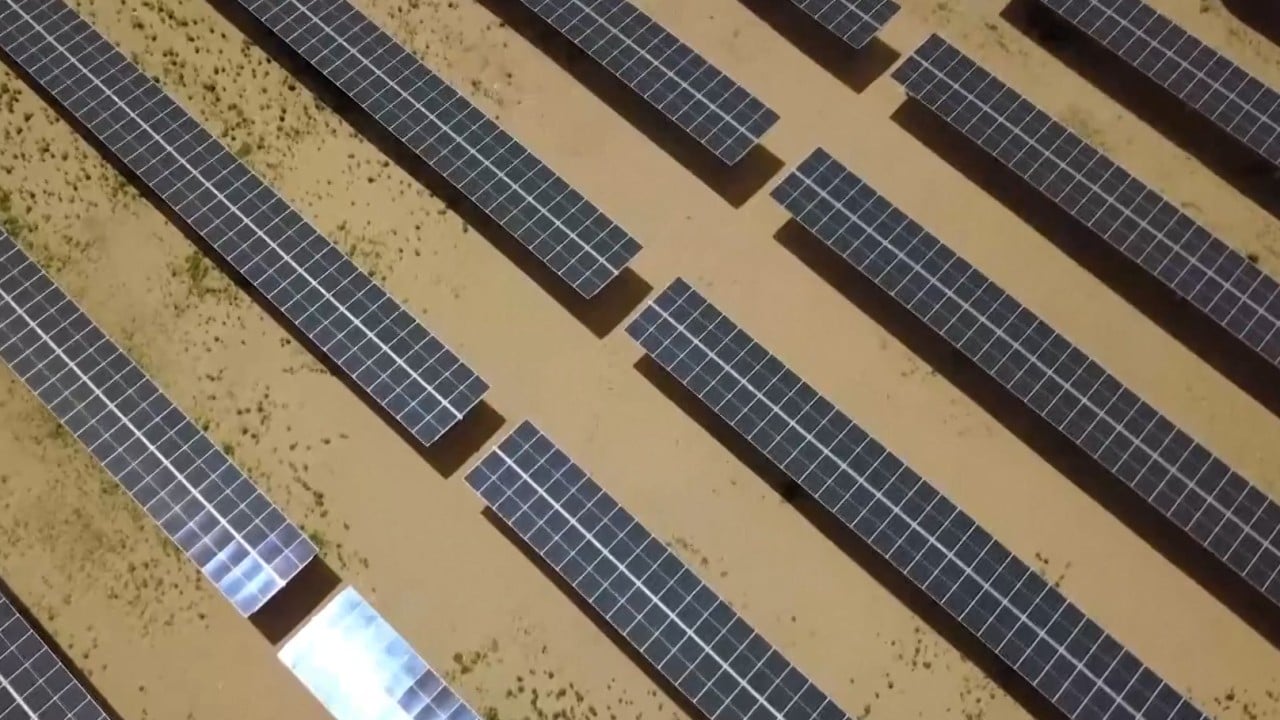

Solar industry leaders suggested that their own sector could provide a glimpse of what lies ahead if the EU does not clamp down on Chinese EVs.

Europe has a mixed record with the Chinese solar industry. The EU imposed anti-dumping tariffs on Chinese solar panels just over a decade ago before pulling them in 2018 in a bid to meet renewable energy goals. One source involved at the time said it was “because the Germans got cold feet”.

EU unveils ‘double act’ plans to cut China dominance of minerals, clean tech

EU unveils ‘double act’ plans to cut China dominance of minerals, clean tech

But accusations of Chinese dumping persist. Two solar industry bodies wrote to political leaders this week asking for emergency purchases of European solar panel stocks, amid concerns that developers had stockpiled Chinese supplies.

A report from research house Rystad Energy in July found that Chinese photovoltaic (PV) panels were piling up in European warehouses, “with approximately 40 gigawatts-direct current (GWdc) of capacity currently in storage – the same amount installed across the continent in 2022”.

“Chinese manufacturers have been increasingly able to undercut the competition on price. Today, panels made in China often cost as little as two-thirds of European-manufactured capacity,” the report concluded.

Walburga Hemetsberger, CEO of industry group SolarPower Europe, said that based on present estimates, “an emergency acquisition could be in the realm of €80 million-100 million”.

“Of course, the cost of inaction is much higher,” Hemetsberger said.

While SolarPower Europe – which has Chinese members – did not name China in its appeal to the EU, the ESMC was pointed, referring to an “intentional and purposeful attack by Chinese PV manufacturers”.

In a letter to the bloc’s leadership, the ESMC called for an immediate EU ban on solar panels made using forced labour, citing the US move to exclude products from Xinjiang as distorting the EU market.

“We cannot compete with and will not turn a blind eye to modern slavery,” it said, saying large volumes of panels turned away from the US due to the Uygur Forced Labour Prevention Act “are now being dumped in Europe”.

The EU is working on a general forced labour ban but it has generated only lukewarm support from some of its 27 member states. Industry experts are pessimistic about its prospects.

“I am sceptical about the feasibility of a forced labour ban. I think energy security has become a national security issue in Europe and that will probably be a higher priority than following through with the forced labour ban for now,” said Alexander Brown, an analyst of China’s solar sector for the Mercator Institute for China Studies.

“In the near future, for Europe to overcome its dependency on fossil fuels and to actually meet more ambitious targets, they may have no other choice but to rely on imports from China.”

[ad_2]

Source link