Singapore to import low-carbon electricity from Australia’s SunCable mega solar project

ALMOST two years after its near collapse, the mega solar project in Australia’s Northern Territory is finally on track with its plans to export low-carbon electricity to Singapore.

The Energy Market Authority (EMA) announced on Tuesday (Oct 22) that it has awarded conditional approval to project developer SunCable to supply 1.75 gigawatt (GW) of solar-generated electricity to Singapore via subsea cables stretching 4,300 km between the two countries.

These low-carbon electricity imports are expected to come onshore “soon” after 2035, said its chief executive officer Mitesh Patel in a separate interview with the media. They are estimated to contribute to 9 per cent of Singapore’s electricity needs by then, and abate 6 million tonnes of carbon dioxide equivalent annually.

“We are actually plugging ourselves into the vision that Singapore has – about Singapore being the backbone of Asean’s interconnected power grid. So this will be an Asean-Australia interconnection,” said Patel.

Considering the scale and the distance between Australia and Singapore, the SunCable project is an ambitious one, said Second Minister for Trade and Industry Tan See Leng, who announced the agreement on the same day on the sidelines of the Singapore International Energy Week.

“But when completed, the project will be a meaningful complement to the Asean power grid and serve as an additional source of electricity for Singapore,” he added.

A NEWSLETTER FOR YOU

Friday, 12.30 pm

ESG Insights

An exclusive weekly report on the latest environmental, social and governance issues.

Next phase of development

With over US$170 million invested in the project thus far, the conditional approval gives SunCable the go-ahead to move on to the next development phase.

This includes enhancing project planning and engineering designs, securing the supply chain for its solar panels and offtake agreements, as well as undertaking subsea surveys in Indonesia through which the cables will have to be routed.

Besides getting approval from Indonesian authorities for the subsea cables to pass through, SunCable also needs to demonstrate that it can fulfil EMA’s technical requirements as well as achieve a commercially viable price acceptable to customers before it is given the conditional licence.

Patel said it is too early to provide a specific price point, but is confident that SunCable will be able to offer competitive prices.

This is because Australia is among the world’s top 5 per cent in sun resources, and the project is also able to supply round-the-clock electricity.

“This helps the resilience and the reliability of the grid, because it is not intermittent power that you usually see with renewable energy projects,” he added.

SunCable expects to achieve financial close by 2027, and will begin construction thereafter.

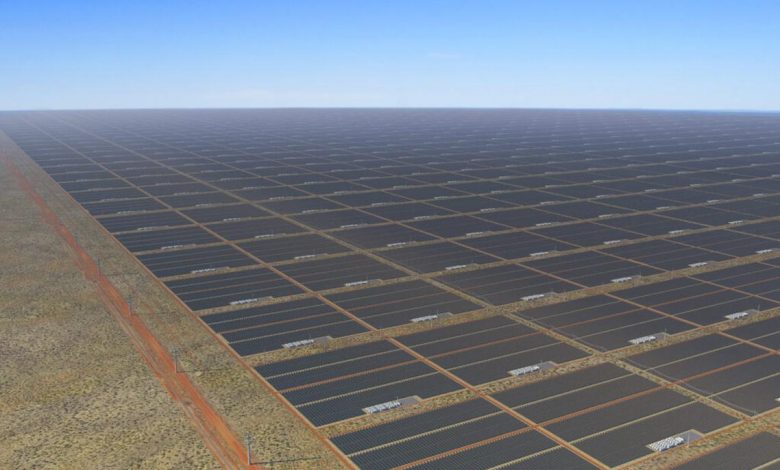

The construction, which is expected to cost US$24.6 billion, will consist of three stages: the solar farm itself and the battery energy storage systems which will be located south of Darwin; the transmission lines from the farm to Darwin; and the subsea cables from Darwin to Singapore.

The solar panels would have a total generation capacity of between 17 and 20 GW-peak, while the battery systems would have a storage capacity of between 37 and 42 GW-hour.

This level of capacity is needed to mitigate the intermittency challenges of solar power, and allow green electrons to be transmitted round-the-clock. Out of these, 3 GW of electricity will be dispatched from the farm, with about 900 megawatt serving an industrial hub in Darwin and the rest for Singapore.

In addition to supplying power to Singapore’s grid, Patel said SunCable hopes to sign offtake agreements with corporations that want to reduce their carbon emissions through an electricity retailer it will eventually set up.

This includes corporates in the pharmaceutical and petrochemical sectors, as well as big tech, which is expected to demand higher energy with the expansion of their data centres.

Singapore was in discussions with SunCable even before it had inked clean-energy import agreements with other host countries, but the project hit a roadblock when the company went into voluntary administration after its two main investors – tech billionaire Mike Cannon-Brookes and mining tycoon Andrew Forrest – fell out over the direction the project should take.

However, Cannon-Brookes managed to rescue the project from collapse, after his privately owned Grok Ventures acquired all of SunCable’s assets in May last year.

Patel said that Grok Ventures’ vision of unlocking the potential of long-distance interconnectors to facilitate the region’s decarbonisation fits in with Singapore’s strategy.

“Our investor is fully committed, and we don’t see any concerns with financial sustainability of the project,” he added.

Cross-border electricity trading

With this latest clean energy import agreement, the city-state is a step closer to achieving its target of importing 6 GW of low-carbon electricity by 2035.

In addition to the SunCable project, Dr Tan also announced on Tuesday that Singapore is looking to further increase cross-border electricity trade with Malaysia, and they are already working with their Malaysian counterparts to advance these discussions.

Singapore had recently announced that additional power supply from Malaysia would double the import capacity of a regional power integration project that links up Laos – with a route through Thailand and Malaysia – and Singapore.

Including other cross-border energy import agreements inked with Indonesia, Cambodia and Vietnam, Singapore could potentially be importing up to 5.6 GW of low-carbon electricity by 2035.

However, most of them are still only given conditional approvals. Only five solar projects in Indonesia, which has committed to supplying 2 GW of solar power, had been awarded conditional licences.

Importing low-carbon electricity is one of four main strategies Singapore is pursuing to decarbonise its power sector, which accounts for 40 per cent of the city-state’s total emissions. EMA has committed to achieving net-zero emissions for the power sector by 2050.

Asean power grid

To further grow the market for cross-border electricity trading in Asean, Dr Tan noted that there is a need to develop its regional infrastructure, especially the Asean power grid.

The region needs to focus on the development of subsea cables, as it moves beyond planning to execution.

To this end, Singapore will be tapping an existing collaboration between grid operator SP Group and energy company EDF on subsea transmission cables, for their expertise in implementing interconnectors in these import projects.

At a meeting in Laos last month, energy ministers around the region had agreed to develop a framework on laying subsea cables and to realise the Asean power grid – which has been in the talks for the last few decades – by 2045.

“Cross-border electricity trading can happen in Asean, so long as we have the collective will to make the Asean power grid a reality,” said Dr Tan.

Beyond Asean, Singapore is also working with the United States on the next phase of their feasibility study on regional interconnectivity.

This second phase will focus on the legal and governance frameworks for regional energy connectivity, as well as its financing mechanisms.

This builds on an earlier study which showed how regional energy connectivity in South-east Asia is technically feasible and yields socio-economic benefits for export countries.