Global trade set to withstand significant headwinds in 2025: QNB

After the sharp collapse in trade volumes in 2020 resulting from the Covid-pandemic, a strong rebound took place in 2021 as the pandemic gradually receded and the global economy began to progressively reopen.

Afterwards, a challenging environment emerged amid rising interest rates, high inflation, and geopolitical instability. These negative conditions resulted in a sharp deceleration of trade activity in 2022, which was even more disappointing in 2023, displaying a highly unusual contraction, QNB noted.

During the last 40 years, a contraction in real trade volumes had only been recorded in 2009 as an aftermath of the Global Financial Crisis (GFC), and in 2020 with the dramatic disruptions caused by the Covid-pandemic.

While some of the headwinds remain relevant today, including a challenging geopolitical environment fraught with protectionism and logistical disruptions, a moderate recovery began to take place in 2024.

In QNB’s view, although global trade growth will remain below the long-term pre-Covid pandemic average, the recovery is set to continue in 2025. In this article, QNB analyses three key elements that support our expectations of a sustained recovery.

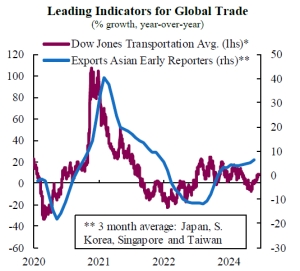

First, key leading indicators point to an improvement in trade volumes. Investor expectations regarding future earnings of companies in the transportation sector are a revealing signal of prospects for global commerce.

The Dow Jones Transportation Average is an equity index that is comprised of airlines, trucking, marine transportation, railroad and delivery companies, whose performance tends to lead the dynamics of global exports. After reaching a low in mid-2024 in year-over-year terms, the gauge has returned to the positive range that points to an expansion in trade.

It is also valuable to track the export performance of highly integrated Asian economies such as Japan, South Korea, Singapore, and Taiwan, which report trade statistics in a timely fashion.

After displaying negative growth during most of last year, in line with the contraction in world trade, this measure began a rising trend that continues in the expansionary range. Overall, leading indicators suggest that trade is set to sustain its recovery.

Second, the Chinese government has announced a battery of aggressive measures to stimulate the economy, contributing to an improvement in the outlook for international trade in the medium term.

During the course of this year, concerns regarding the performance of the Chinese economy started to mount amid deflationary pressures, the real estate crisis, and negative momentum in investor sentiment. Economic growth expectations for 2024 fluctuated between 4.5% and 4.9%, significantly below the 10-year average of 5.6%.

In a strong response, Chinese authorities set forth a series of coordinated monetary, financial, and fiscal measures to provide support to the world’s second largest economy.

QNB expects the comprehensive package of policy measures to bolster economic growth in China and East Asia, creating further momentum in the most dynamic trading region of the planet. This should further support an acceleration of overall trade growth.

Third, the policy interest rate cutting cycles by major central banks will give trade an additional boost. Given the progress in bringing inflation under control, the US Federal Reserve and the European Central Bank are embarking on a significant process of monetary easing.

This cycle, QNB noted, is expected to take policy rates from restrictive territory towards accommodative levels by end-2025. International trade is highly sensitive to credit and interest rates, given their influence on investment by firms and on the demand of durable goods by households, which are major components of trade flows. Thus, the monetary easing cycle in advanced economies will add momentum to global trade growth.

“All in all, absent a major escalation in protectionism and geopolitical disruptions, we expect growth in volumes of trade to continue to recover, increasing to 3.2% in 2025, from an expected 2.8% this year, amid positive leading trade indicators, aggressive economic stimulus measures in China, and the policy interest rate cutting cycles in advanced economies,” QNB added.