Temu sellers struggle with disputes amid complex company structure outside China

“Given the cross-border nature of these transactions, it’s logical for both parties to agree on a dispute resolution method and set Hong Kong as the arbitration venue,” said Wu Libin, senior partner at M&T Lawyers. “However, many merchants are unfamiliar with Hong Kong’s legal framework, and the high costs of litigation pose a significant barrier to seeking legal remedies.”

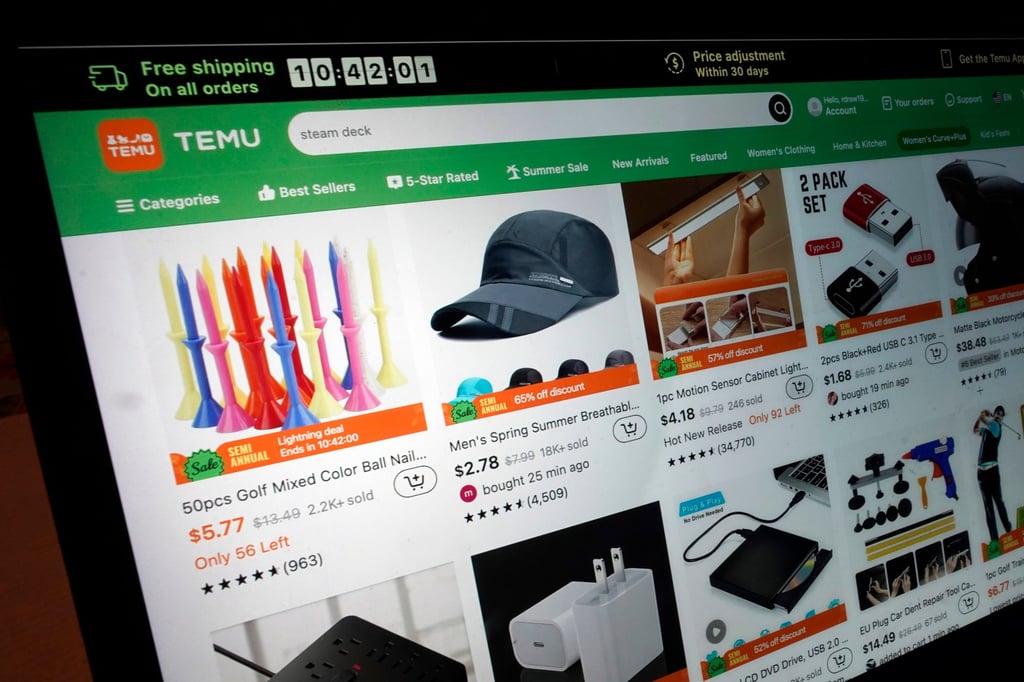

Merchants said that the company’s agreements disadvantage them, with updates often appearing as pop-up windows on the seller’s back-end system, requiring immediate consent to continue operations. This has resulted in some cases to hundreds of thousands of dollars in fines and withheld earnings over issues such as alleged intellectual property infringement and poor product quality.

In response, hundreds of suppliers stormed the office of Temu logistics affiliate in Guangzhou.

In a statement to the Post, Temu said the disputes stem from dissatisfaction with how the platform handles after-sales issues related to product quality and compliance. “These merchants have declined to resolve the disputes through the normal arbitration and legal channels stated in the seller agreements,” Temu said.

While digital contracts are legally valid, Wu said there is still a need to scrutinise whether the platform operator is exploiting its dominant position.

“Legally, if a standard contract is significantly unfair or open to multiple interpretations, it should be construed against the party that drafted it,” he said. “Sellers seeking legal remedies must demonstrate that the contract is significantly unfair or that its terms are ambiguous.”

“Initially, the penalty for merchants may be larger due to the delayed impact from accumulated sales, as well as possibly less focus on compliance and consumer complaints given Temu’s small scale last year,” UBS said in the report. “This should gradually smooth out as Temu’s penalty policies are executed on a more real-time basis and merchants become increasingly compliant with the requirements.”

Screenshots provided by Temu suppliers show that the platform has changed the terms used on the back end that are points of reference in their disputes. For example, the term “after-sales release amount” was changed to “non-merchant responsibility platform after-sales subsidy.” This refers to payments withheld by the platform when there are after-sales issues.

Some merchants are unhappy with Temu’s refund-only policy, which allows consumers to request refunds without returning products or providing proof of loss or damage, raising concerns about potential abuse.