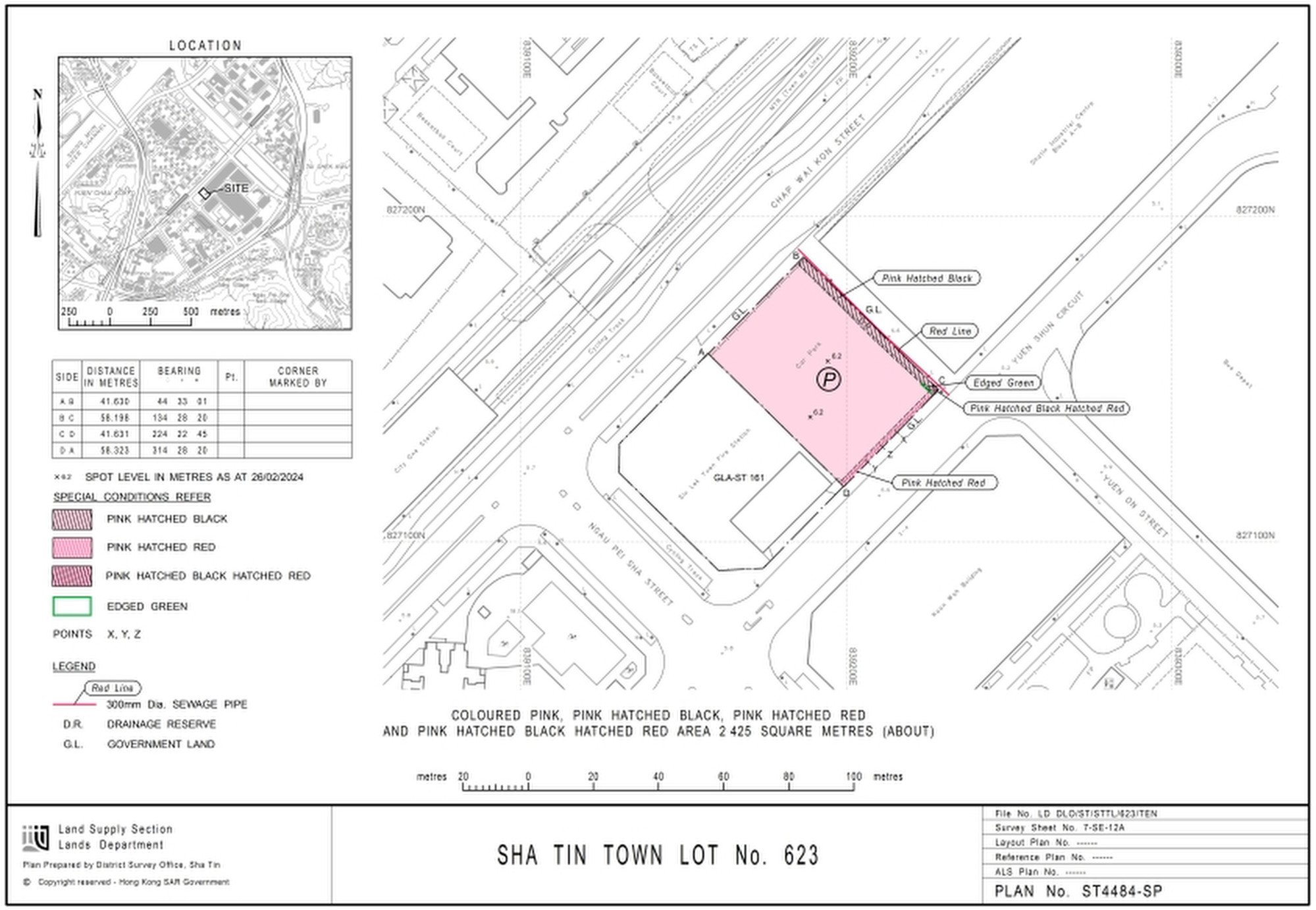

SHKP wins hotly contested plot of land in Sha Tin for price at mid-point of estimates

That is roughly the mid-point of estimates of HK$3,000 to HK$5,000 per square foot before the sale.

Other developers to submit bids included CK Asset Holdings, Sino Land, Great Eagle and Citic Pacific, the department had revealed on Friday.

“Property prices are still in a period of adjustment, and coupled with high interest rates and high construction costs, developers have been relatively cautious in their bids,” said James Cheung, executive director at Centaline Surveyors.

“The land was granted for HK$619 million, which is considered to be the middle-range of market expectations, and it is expected to be developed into small and medium-sized flats to meet demand for housing in the district.”

But the price per square foot is less than half that of the most recent residential land sale in Sha Tin. A plot on Hin Wo Lane received 17 bids and sold for HK$786 million, or HK$8,802 per square foot, in September 2022, according to Alex Leung, senior director at CHFT Advisory and Appraisal.

He said that was also a relatively small development project, and therefore a good reference for the Yuen Shun Circuit sale. Vanke Overseas Investment Holding and Wing Tai Properties won the bid for that parcel.

The latest site is close to the City One MTR station and its scale is “moderate”, meaning the investment risk is relatively low, surveyors said.

The lack of activity in the market is affecting secondary home prices. The official price index from the Rating and Valuation Department fell 1.22 per cent in May, reversing a 0.5 per cent improvement in April.

The May index reading of 305.9 was the lowest in almost eight years, comparable to November 2016 when it sank to 306.7, according to JLL.