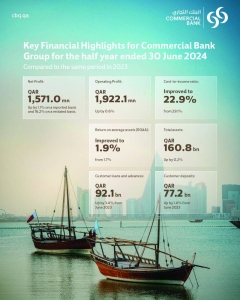

Commercial Bank earns half yearly net profit of QR1,571mn

The H1-2023 numbers were restated due to the restatement of the year-end 2023 financial statements for the underlying derivative on the share option performance scheme.

Accordingly, the current H1-2024 figures are compared with the previous-year restated numbers, Commercial Bank said yesterday.

The Group’s balance sheet (as on June 30, 2024) totalled QR160.8bn.

Commercial Bank Group’s loans and advances to customers have increased by 3.4% to QR92.1bn (as on June 30, 2024) compared to QR89bn in June 2023, mainly due to increased government. and customer deposits have increased by 1.4% during the year to QR77.2bn (as on June 30) compared with QR76.1bn in the same period in 2023.

Commercial Bank chairman Sheikh Abdullah bin Ali bin Jabor al-Thani said: “In the first half of 2024, Commercial Bank demonstrated strong performance despite the global banking sector’s challenges. Forbes once again recognised us among the ‘Middle East’s 30 Most Valuable Banks 2024’.”

“Additionally, Fitch affirmed our rating at ‘A’ with a stable outlook. Our unwavering commitment to technology and innovation has enabled us to provide exceptional services that enhance the customer experience. During this period, we received the ‘Best Mobile Banking App’ and the ‘Best Remittance Service’ awards from the MEED–Mena Banking Awards 2024, reflecting our dedication to outstanding customer service.

Commercial Bank’s vice-chairman Hussain Alfardan said:

“We are pleased to report Commercial Bank’s performance in the first half of 2024, reflecting the strength of the Qatari economy and our steadfast commitment to operational excellence.

“We are dedicated to maintaining Commercial Bank’s position as a leading banking provider in the region, continuing to contribute to the ongoing growth and prosperity of Qatar’s economy, and supporting our customers and stakeholders in achieving their financial goals.”

The Group’s net provisions fell to QR426.9mn for the six months that ended on June 30 this year, from QR575.5mn in the same period in 2023, due to higher recoveries and ECL release.

Non-performing loan (NPL) ratio stood at 5.9% in June compared to 5.5% in the same period last year.

Commercial Bank’s Group chief executive officer Joseph Abraham commented: “Throughout the first half of 2024, Commercial Bank continued to execute on our five-year strategic plan, we continue to focus on shaping our business as a leader in client experience and digital innovation, resulting in positive financial performance for the period ending 30 June 2024.

“As loan growth continued to show positive momentum reflecting the strong pipeline, capital also continued to improve to 17.2% in line with our guidance and we will continue to focus efforts in the second half of the year to continue this positive momentum.

“The Group witnessed an improvement in its cost-to-income ratio, reaching 22.9%, compared to 29.1% in the first half of 2023. This reduction in expenses was largely attributed to decreased staff related LTIP compensation costs, a consequence of IFRS 2 due to the decline in share price.

“Our associates have demonstrated a strong performance, which grew by 8.9% increase in share of associates, reaching QR158.2mn compared to QR145.3mn in the same period of 2023.”