Saudi wealth fund’s local focus worries global asset managers

As Saudi Arabia ratchets up efforts to reshape itself, the government’s looked to the Public Investment Fund to lead the way. But an increased focus on domestic projects like the $1.5tn Neom has global asset managers fretting that it will have less cash to spend abroad.

While the fund plans to ramp up annual spending to as much as $70bn, executives at three alternative investment firms have privately expressed concerns that the PIF will channel more money into local mega-projects. That could lead to a pivot away from passive investments in global private equity, infrastructure and hedge funds, people familiar with the matter said.

It’s a stark shift from recent years, when wealth funds from the Middle East were eager to deploy billions of dollars with some of the world’s largest investors. The $925bn PIF has been an especially prolific backer to the likes of BlackRock Inc and Brookfield Asset Management.

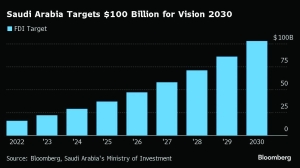

Officials in the kingdom had looked to draw foreign investment to help pay for at least a portion of Crown Prince Mohamed bin Salman’s Vision 2030 agenda, but that money hasn’t rolled in as expected. That’s led to additional pressure on the PIF, which is the main entity tasked with driving the multi-trillion-dollar economic diversification plan.

Representatives for the PIF declined to comment.

“For some time, it seemed like everyone wanted a piece of the Saudi pie that the PIF was serving. Plenty of people simply saw the fund as a bottomless war chest,” said Robert Mogielnicki, senior resident scholar at the Arab Gulf States Institute in Washington.

“The reality is that the PIF operates under various constraints, and the rapidly expanding scale and scope of investments have significantly increased its obligations.”

The need to boost spending so aggressively at a time when the government budget is expected to be in deficit until at least 2026 has created a sense of pressure to find new ways to raise money. The PIF had $15bn in cash and equivalents as of September.

The fund has publicly said its allocation to international investments as a proportion of the total outlay could drop by as much a third. But as it increases total annual deployment, the absolute dollar figure earmarked for deals outside the kingdom should also rise.

The PIF is expected to continue to do direct investments globally and one potential outcome could be a focus solely on deploying money to top-tier names, according to executives at two private equity firms. The fund could also prioritise entities with a significant local presence, given the government’s focus on building up the domestic asset management industry.

While few financial firms have so far established regional headquarters in the Saudi capital, there has been growing pressure to do so. Late last year, the head of the fund’s Middle East and North Africa unit Yazeed al-Humied urged firms to set up “not just their reception desks but their kitchens” in Saudi Arabia if they want to continue raising money from the PIF.

Changing dynamics

Al-Humied and his team have grown in stature from the PIF’s local pivot, people familiar with the matter said. More deals are being routed through his group, giving the executive greater sway at one of the world’s largest sovereign investors.

For instance, two of the fund’s biggest deals in recent months — a mobile towers deal and a $5bn commitment to BlackRock for Gulf investments — were both regionally focused and orchestrated by the Mena unit.

“There is a focus on domestic investment and the PIF will continue to do so, but it also needs external investments to grow to fund its operations,” said Karen Young, a senior research scholar at Columbia University’s Center on Global Energy Policy. “So there will be a balance between capital raising at home and investing externally for returns.”

Al-Humied’s team is also taking on a greater role in the fund’s activities outside the Middle East, the people said. They led the way on some international deals that were considered a key part of the PIF’s strategy to bring foreign companies and technologies into the kingdom to help with its diversification strategy.

In an example of how the kingdom wants to deploy its cash, a unit of the PIF on Wednesday said it would invest in a convertible bond issued by Lenovo Group Ltd. In return, the Chinese computer-maker will open a manufacturing facility and establish a so-called regional headquarters in Saudi Arabia.

Previously, the $4.9bn acquisition of US-based video game publisher Scopely by the PIF’s gaming unit was led by the Mena team because it was seen as a key step to kickstarting the local gaming industry. Plans to invest in the ATP Tour as part of a plan to expand in professional tennis, are also being done through the fund’s sports unit and led by al-Humied’s team, according to the people familiar with the matter.

Hired in 2015 as an adviser to the PIF’s Governor Yasir al-Rumayyan, al-Humied became deputy governor for Mena investments in 2021. He was promoted alongside Turqi al-Nowaiser, who is responsible for international investments and also serves as deputy governor. Al-Humied has been close to al-Rumayyan for years, and the two have previously worked together at the Saudi markets regulator.

In another sign of the pivot, the PIF — once among the most prolific investors in US stocks — recently cut its holdings there to about $18bn from $35bn. It no longer holds stakes in Amazon.com Inc, Microsoft Corp and Salesforce Inc, replacing direct holdings with call options on fewer shares — a move that allows it to maintain some exposure to the companies with less capital at risk.

Funding gaps

Currently, about 27% of the PIF’s assets are outside Saudi Arabia, according to data provider Global SWF. “We expect this percentage to stay relatively stable,” as the fund’s local investments ramp up faster than growth in international deals, said Diego Lopez, who’s head of the research consultancy.

The fund will continue to do deals outside the kingdom through the international investments team, people familiar with the matter said, though these are expected to be opportunistic, or will be more focused on sectors that help boost the local economy.

For instance, the government is keen on growing the Saudi mining industry and will look to deploy capital internationally within that sector, the people said. It’s also in talks with Andreessen Horowitz for investments into artificial intelligence — those discussions are still at an early stage but could see the Saudi fund pour $40bn into AI technologies, although the timeframe for that is unclear.

But those aspirations will have to be weighed against the PIF’s hundreds of billions of dollars of local commitments for everything from building new manufacturing industries to entirely new cities.

“The domestic dimension of the PIF’s role has become ever more important in past years,” according to the Arab Gulf States Institute’s Mogielnicki.

“Even many of the fund’s international investments appear to be viewed through the lens of domestic dividends,” he said. “International investor interest in the PIF isn’t disappearing soon, but there is likely to be more selectiveness on all sides.”