Tourists’ slow return to China post-Covid causing headaches for travel industry

[ad_1]

In March, it also resumed issuing tourist visas to all countries.

Then last month, it dropped all pre-entry Covid-19 test requirements for inbound passengers following a series of measures to encourage international travellers, including allowing businesspeople to obtain a visa on arrival and tourists to be exempt from fingerprint collection.

Recovery in China’s tourism sector has been slow, with a 70 per cent drop in international travellers in the first half of this year compared with pre-Covid levels – from close to 31 million who entered and exited the country in the same period in 2019 to around 8.44 million, Chinese immigration data shows.

Liu Xiangyan, an associate researcher with the International Tourism Institute at the China Tourism Academy, a research institution under the Chinese Ministry of Culture and Tourism, said some of the reasons holding people back from going to China may include the faster recovery of tourism industries in parts of Asia that reopened earlier plus lower costs in some Southeast Asian countries.

She predicted it could take another three years for visitor numbers to reach their pre-pandemic levels.

Anti-China policies have had ‘profound’ impact on travel, industry body says

Anti-China policies have had ‘profound’ impact on travel, industry body says

“From the point of view of the main body of the market, because the whole industry has had almost no business, with no foreign or inbound tourists in the past three years, [the industry] and their partners, the businesses on the upper and lower chains, will need to re-establish contact and connection,” she said. “The past three months was still a period for many travel agencies and service providers to restart their business.”

According to data from the Chinese Ministry of Commerce, countries such as South Korea, Russia, Japan, the United States and Australia were among the biggest international tourist markets for China in 2019, but booking data showed it may now be less attractive as a travel destination compared with other countries.

According to US-based travel booking platform Expedia, Tokyo and Singapore were the most booked East and Southeast Asian destinations for Apec travellers in the second quarter of the year. Japan fully reopened its borders in October 2022, while Singapore reopened to fully vaccinated international travellers in April last year.

Searches on Expedia also show return tickets from San Francisco to Tokyo and Singapore in August cost around US$2,100 and US$1,500 respectively, while a flight to Shanghai cost around US$2,600.

Data provided by Expedia showed that global flight demand for Shanghai and Beijing, the most popular destinations in mainland China, increased by 155 per cent and 205 per cent respectively in the second quarter of 2023 compared with the previous quarter, while global hotel demand for the two cities increased by 270 per cent and 250 per cent respectively.

Expedia said that while flight demand for China’s top destinations in the first half of 2023 stood at 40 per cent compared with the same period in 2019, while hotel demand was 25 per cent of that in the same period, there had been a positive quarter-on-quarter growth in demand.

China CYTS Tours, a San Francisco-based travel agency, has seen a 95 per cent drop in business since 2019. It operated fewer than 10 tours to China in the past three months, compared with around 200 for the same period before the pandemic.

Its chief executive, Charlie Zheng, attributed the shrinking of China travel to the lack of flights from the US, which he believed was mainly due to political tensions between the countries.

“There’s been no direct flight … from San Francisco to Beijing for three years,” he said. “We hope, you know, they can [be restored] soon, but we don’t think it’s easy because there are so many problems between China and the US.”

At present, there are only 12 direct flights between the US and China each week. However that is expected to increase to 18 in September and 24 in October under a new agreement announced recently by the White House.

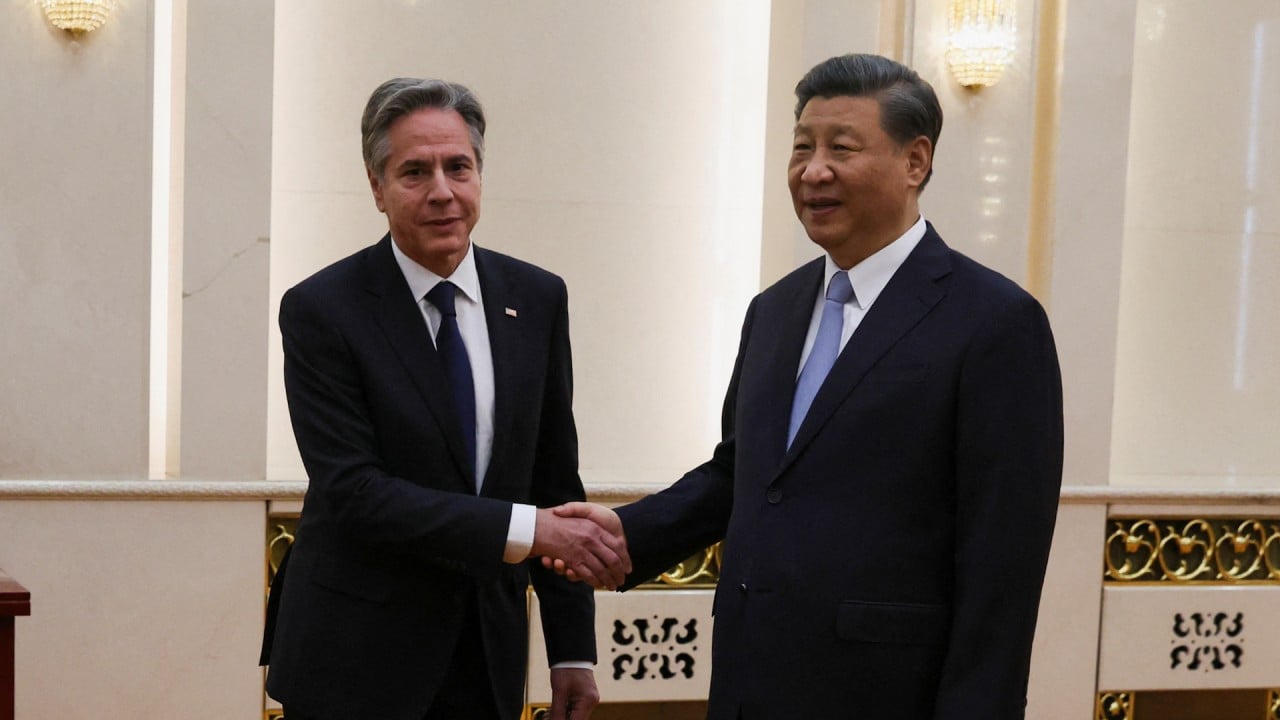

For months, Beijing and Washington have been negotiating to increase the number of direct flights between the two countries. There were more than 300 flights a week before the pandemic. Some progress has been seen following US Secretary of State Antony Blinken’s trip to China in June, according to Reuters, citing the US Department of Transportation.

Air China and China Eastern Airlines both applied to the department to increase flight numbers from China to the US after the announcement, according to Yicai, as most Chinese carriers ramp up efforts in resuming more international routes in response to government calls to boost inbound tourism.

Scott Moskowitz, senior analyst of APAC at Morning Consult, a New York-based business intelligence firm, said beyond cost and logistical issues, growing tensions between China and the West are a major reason driving travellers away from China.

Letting more inbound tourists come to China to see the real China can help eliminate their incorrect or untrue perception of China

He said hostile moves by Beijing against foreign businesses operating in China have made headlines and have probably left travellers questioning how welcoming China is to foreigners.

“What’s more, our data shows that significant majorities in both China and the US expect bilateral military and economic tensions to get even worse in the coming year. Expectations like these will likely make people hesitant to make costly future plans for a trip to China,” he said.

According to a Morning Consult survey in August, more than half of both people in the US and in China think it is probable the two countries will have military and economic tensions in the coming year, while more than 60 per cent of them hold unfavourable views towards each other’s countries.

Meanwhile, European nations are now more aligned with Washington’s China policy, attempting to de-risk from China after long-standing economic overdependence and trade imbalances.

Germany, which is China’s biggest EU trading partner, became the first in the bloc to unveil specific strategies focused on de-risking with China.

Maximilian Butek, executive director of the Shanghai office of the German Chamber of Commerce in China, admitted that the growing trend of de-risking, geopolitical tensions, and media portrayal of a slowing Chinese economy are all reasons that discourage many German businesses, which no longer have the same level of curiosity and confidence in the Chinese market as before the pandemic.

China ends Covid-era bans on group travel to the US and Japan

China ends Covid-era bans on group travel to the US and Japan

He said there were very few German business delegations travelling to China this year, compared with around 50 each year before the pandemic.

Data provided by the German Chamber of Commerce also showed exhibitors from Germany, which previously accounted for the largest number of exhibitors at the China International Import Expo, have been decreasing since a peak of 205 companies in 2019.

“New companies are currently not coming because they don’t have fear of missing out,” Butek said. “Of course you want to explore business opportunities and you want to expand your business. But currently the curiosity of missing out in China is not as big as it was in the boom years of the last 30 years.”

Butek said while German companies are diversifying their supply chains to other markets to mitigate risks, a majority of them are still interested in investing in China. But instead of investing new capital, they would prefer to reinvest their profits in China.

“That means going out of China and going further into China,” he said. “We also believe, looking at the fundamentals, that the growth will happen in the future again.”

China has stepped up measures in boosting foreign investments, which fell to a 25-year low in the second quarter this year. It released a new set of guidelines last month aimed at strengthening the protection of foreign investments including their intellectual property rights, improving immigration policies for foreign employees, and increasing tax and fiscal support by temporarily exempting withholding income tax for foreigners reinvesting their profits in China.

The European Union Chamber of Commerce in China said while travel facilitation measures for businesspeople could help address some of the inefficiencies felt by the foreign business community, these changes alone are unlikely to lead to a significant increase in the volume of EU-China business exchanges.

“For this to happen, other issues related to both the overall business environment and operating conditions for foreign companies – including the lack of transparency and predictability of China’s policy environment – need to be addressed,” the chamber wrote in a note to the Post.

It added that the ambiguous rules and regulations, market access barriers, and structural economic problems such as mounting debt burden and prolonged weakness in consumption remain concerns of European businesses following China’s reopening.

Einar Tangen, senior fellow at the Taihe Institute and founder of Asia Narratives, said China’s new measures to attract foreign travellers will have a larger effect on the Global South, rather than Group of 7 countries, which he said have increasingly painted China as “an aggressive, rogue nation”.

“American and European companies will continue to engage and send people to keep and compete in China’s markets. China will have to not only institute policies, but make sure the bureaucracy follows through on them,” he said.

She also suggested other measures to help, such as leading tourism publicity campaigns and distributing more resources into the emerging tourism markets, including those under the Belt and Road Initiative.

“I think the strategic attention the country gives to inbound tourism can still be improved. We know that inbound tourism is actually a form of non-governmental diplomacy,” she said. “Letting more inbound tourists come to China to see the real China can help eliminate their incorrect or untrue perception of China that is brought by some negative, unfair or one-sided reports from mainstream media.”

[ad_2]

Source link