Why China-South Korea trade drop-off may persist as US influence weighs on chips and tech

[ad_1]

The approved shipment of two graphite materials since late December, as reported by South Korea’s Yonhap News Agency on Sunday, came as the country saw its first trade deficit with China in three decades.

Graphite materials are widely used in batteries, fuel cells, metallurgy, and as a crucial component in the manufacturing of electronic devices. About 93.7 per cent of the synthetic and natural graphite that South Korea imported in 2022 came from China. China also remains South Korea’s biggest trading partner by a large margin.

However, Beijing has stepped up its efforts to reduce external dependencies amid prolonged trade tensions with Washington. It tightened up exports of the key battery material in late October, affecting downstream buyers in Japan, the United States, India and South Korea.

China raises ‘serious concerns’ over US chip-making curbs, supply chain probe

China raises ‘serious concerns’ over US chip-making curbs, supply chain probe

But the tension that spilled over to South Korea has shown signs of easing since leaders from China and the US met in November.

China’s Ministry of Commerce had said at a press conference in mid-December that it approved some graphite export license applications, but no details were provided.

“This easing of restrictions doesn’t mean trade relations between China and South Korea are heating up – it’s just a return to normal,” said Lu Xiang, a researcher with the Chinese Academy of Social Sciences, one of China’s most influential think tanks.

South Korea, caught between the two superpowers, reported a trade deficit of US$18 billion with China in 2023 – its first such deficit since they established diplomatic relations in 1992, according to data from the South Korean Ministry of Trade, Industry and Energy (MOTIE).

Its figures show South Korea’s exports to China fell 20 per cent from a year earlier and that imports from China decreased 8 per cent from a year prior.

South Korea’s annual trade surplus with China hit a record high of US$68.22 billion in 2013. The US-China trade war began in July 2018, when the surplus was US$55.64 billion, and it eroded further during the pandemic years.

South Korea was China’s fifth-largest trading partner last year, following Asean, the European Union, the United States and Japan, according to China customs.

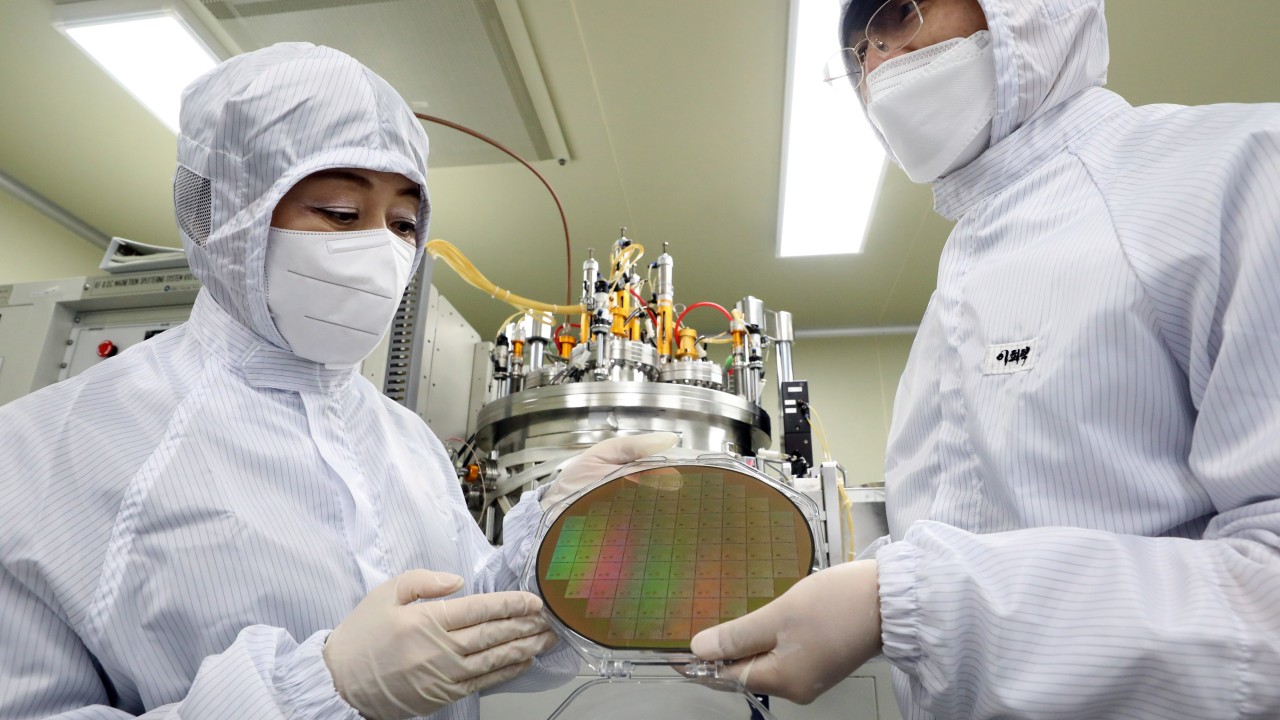

South Korea’s major shipments to China are integrated circuits and chemicals for the textile industry, while its imports include lithium-electronic batteries and chemicals used in battery catalysts.

Bilateral competition is heating up, as the two countries have many overlaps in their industrial and export structures, including electronics, batteries, automobiles and seafaring ships.

We will see South Korea’s trade deficit with China continue this year

Lu said that South Korea’s exports of vessels and automobiles are losing ground to China, and that cutbacks in chip exports to China amid pressure from Washington are affecting the economic and trade patterns between these neighbouring countries.

“We will see South Korea’s trade deficit with China continue this year, as [Seoul] actively cuts off chip exports – its most potent export,” he added.

South Korea has already begun seeing a shift in exports. In December, its monthly exports to the US surpassed those to China for the first time in 20 years, according to MOTIE.

Meanwhile, China’s exports to the US last year saw their biggest slump in almost three decades, as exports fell by 13.1 per cent compared with a year earlier.

[ad_2]

Source link