Singapore’s banking giants entangled in US$740 million money-laundering scandal

[ad_1]

In charge sheets seen by Bloomberg News, some of the individuals who were arrested and charged this month held funds totally millions from unlicensed moneylending in China, and illegal gambling in United Overseas Bank and the local units of Citigroup and RHB Bank. They also allegedly tried to cheat banks Oversea-Chinese Banking Corp, Standard Chartered and CIMB Bank using fake documents, the charge sheets show.

The wide roster of banks joins property agents, precious metals dealers and golf clubs in the city that have been drawn into this scandal. This has raised questions about crash barriers against illicit money flowing into one of the world’s most important financial hubs.

The accused allegedly used their criminal proceeds to buy luxury cars, Tether stablecoins and, in one case, an upscale condominium unit near the city’s prime shopping belt for S$23 million, the charge sheets show. Some also allegedly had millions in safe deposit boxes held with Certis Cisco Security, a security firm backed by state investor Temasek Holdings.

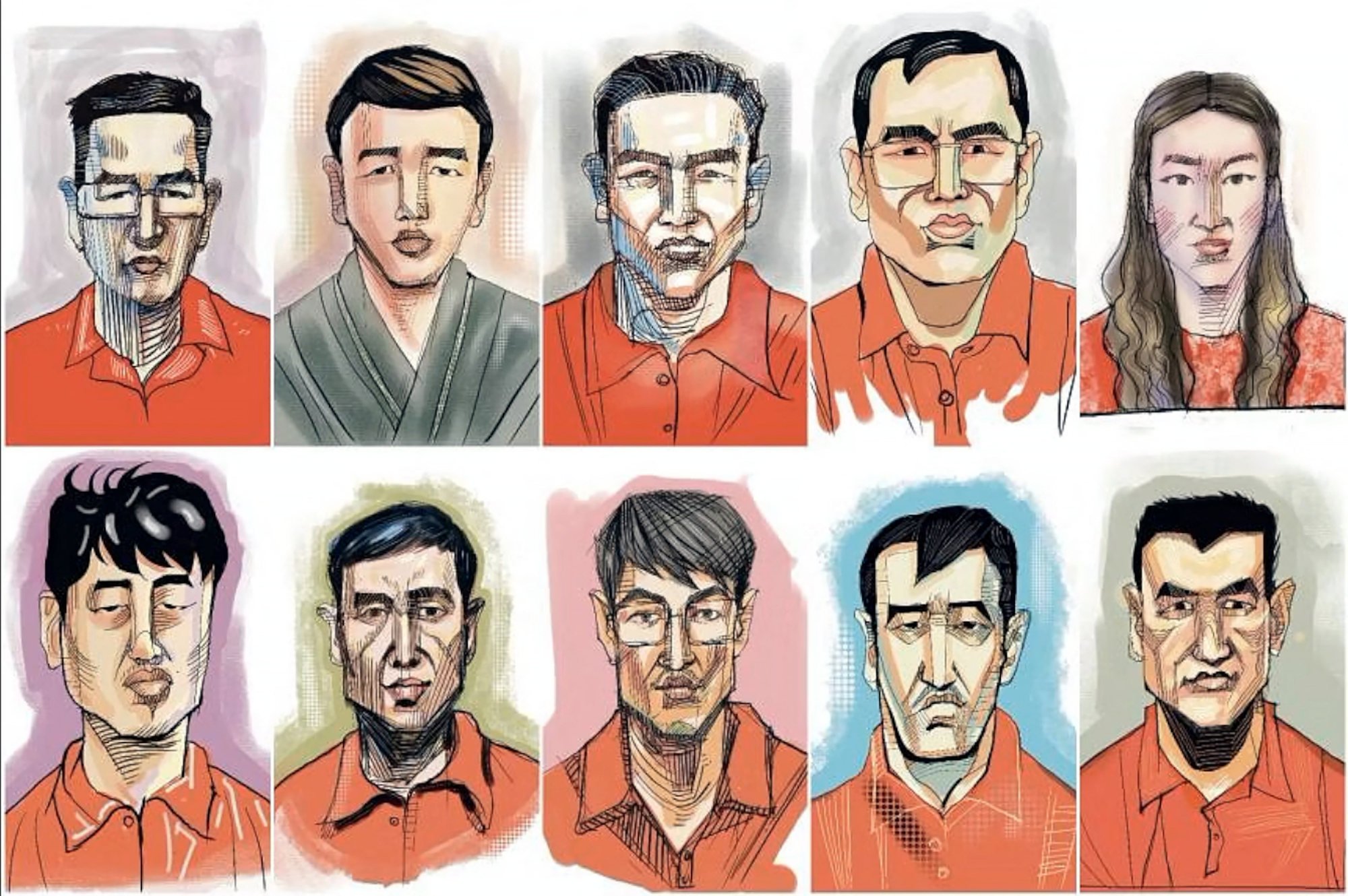

Most of the 10 people arrested were charged with more offences on Wednesday in court. Authorities have earlier said they are seeking documents from at least 10 financial institutions in relation to the case, although they were not named.

Singapore files charges against 10 with ‘Chinese passports’ in money-laundering bust

Singapore files charges against 10 with ‘Chinese passports’ in money-laundering bust

All 10 who appeared in court via video link on Wednesday were denied bail and remanded until September 6, with eight facing fresh charges.

These included having millions in bank accounts and safe deposit boxes, cryptocurrencies and cars as “benefits from criminal conduct”.

Their lawyers sought bail but gave no indication of how the suspects would answer the money laundering accusations.

Prosecutors said the suspects were a flight risk if given bail, as they had overseas connections and assets, and could also collude to contaminate evidence.

In all, 105 properties, bank accounts with S$110 million, 50 vehicles, S$23 million in cash, hundreds of luxury handbags and watches, and jewellery and two gold bars were seized in the August 15 raids at nine locations.

Eight more suspects are wanted and 12 are assisting in investigations, police have said.

Separately, DBS Group Holdings, the country’s largest bank, and Bank of Singapore, OCBC’s private-banking arm, are both creditors to investment firms linked to two accused individuals, according to business filings seen by Bloomberg News.

In the filing, DBS registered four charges – generally referring to a form of security interest usually taken by a lender to secure repayment of a loan – on August 18, 2021 to Aiqinhai Investment. The firm’s director and sole shareholder Su Haijin is among the 10 individuals who have been indicted in a Singapore court for offences including money laundering and forgery.

Singapore arrests 2 teens, 11 others for links to banking-related malware scams

Singapore arrests 2 teens, 11 others for links to banking-related malware scams

Bank of Singapore registered a charge on January 7, 2022, for Xinbao Investment Holdings. One of the firm’s two directors is Su Baolin, who was also among the individuals charged.

Both the investment firms linked to DBS and Bank of Singapore have listed office addresses in Singapore’s business district, while the two accused directors have upscale residential addresses. The banks’ facilities are secured against “all monies” at the companies, according to the filing, which did not specify the size of the exposure.

A spokesperson for DBS said the lender will continue its work “to make Singapore a place where criminals cannot find harbour”, though did not comment on specific names.

Citi’s spokesperson said the bank had been working with authorities to strengthen and protect the integrity of the financial system, adding it was committed to ensuring the highest standard of governance and controls. OCBC declined to comment. Standard Chartered, RHB, CIMB and Certis Cisco didn’t immediately respond to a request for comment.

Su Haijin and Su Baolin are both in remand. Su Baolin’s lawyers declined to comment, while Su Haijin’s lawyers did not immediately respond to a request for comment.

The Monetary Authority of Singapore, when asked by Bloomberg News for comment, referred to its earlier statement where it said the regulator is undertaking supervisory engagements with financial firms where potentially tainted funds have been identified, and will take “firm action” against those found to have breached anti-money-laundering and related rules. The police did not immediately respond to a request for comment.

[ad_2]

Source link