UK unveils voter-friendly budget with election on horizon

[ad_1]

Britain’s Conservative government launched plans on Wednesday to stimulate growth and woo voters for the next general election, delivering a massive tax-cut sweetener for workers but also forecasting sharply lower growth and stubbornly high inflation.

Finance minister Jeremy Hunt unveiled a huge package of 110 measures aimed at reinvigorating the ailing economy and boosting business investment by some £20 billion (US$25 billion) per year.

The speech sets the battleground for next year’s expected general election as Prime Minister Rishi Sunak bids to claw back ground lost to the main opposition Labour party, having already achieved his target to halve inflation.

Wednesday’s budget was also set against the backdrop of a cost-of-living crisis which has eroded wages, sparked strikes and left millions of Britons struggling to pay bills – and handed a major boost to Labour.

The government wants to turn a corner after the Covid-19 pandemic and spiking energy bills caused by Russia’s invasion of Ukraine sparked unprecedented state intervention to support the economy and cash-strapped households.

“After a global pandemic and energy crisis, we have taken difficult decisions,” Hunt told lawmakers in parliament.

“We have supported families with rising bills, cut borrowing and halved inflation.

“Rather than a recession, the economy has grown. Rather than falling as predicted, real incomes have risen. Our plan for the British economy is working. But the work is not done.”

Sacked UK minister Braverman attacks PM Sunak as failing and weak

Sacked UK minister Braverman attacks PM Sunak as failing and weak

The most eye-catching tax cut was an overhaul in national insurance, a payrolls tax paid by employees and employers that will effectively be slashed with effect from January.

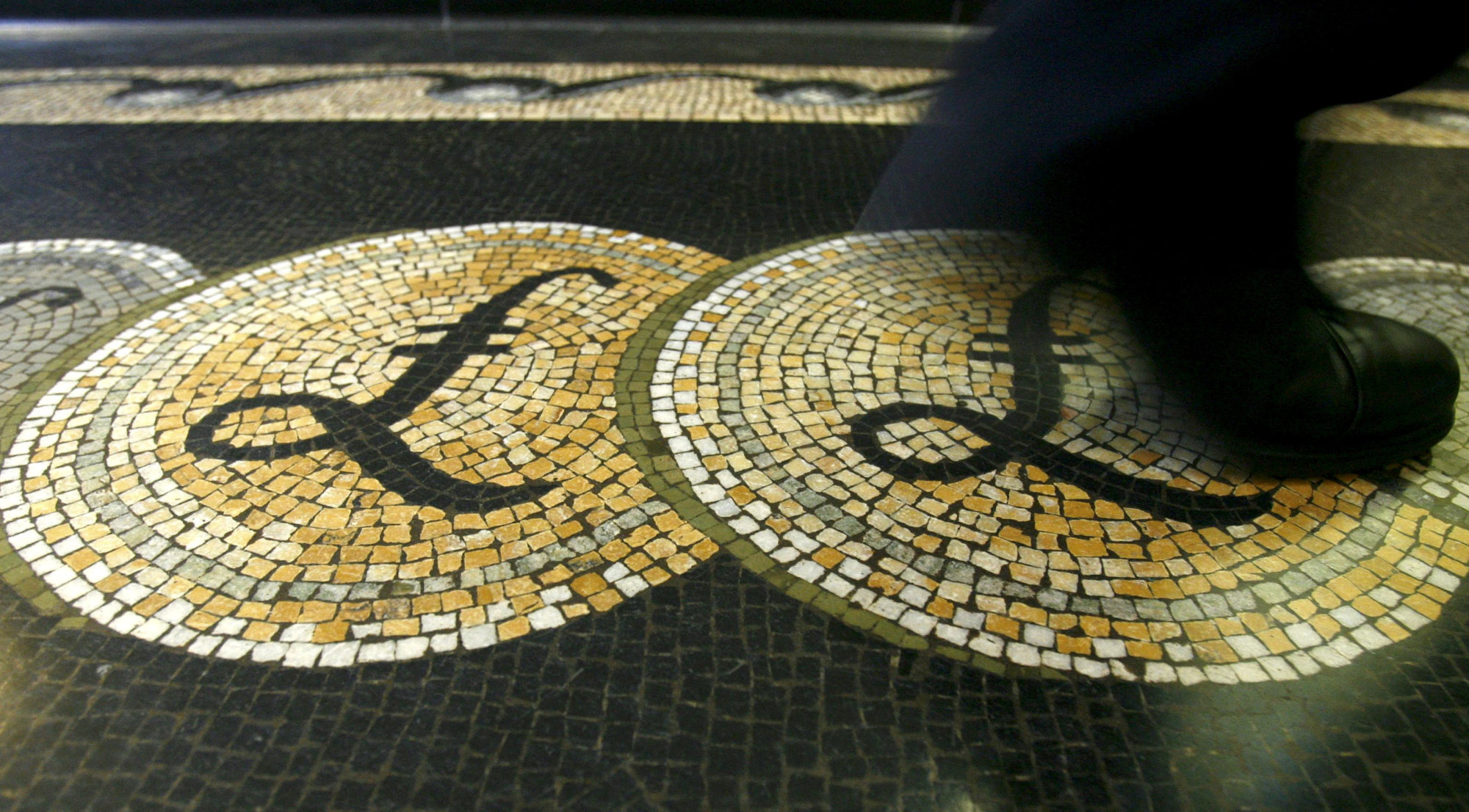

Chancellor of the Exchequer Hunt declared the move as the “biggest permanent tax cut in modern British history” for 29 million workers that was worth £9.0 billion () per year.

He will lower the main national insurance rate by two percentage points, saving someone earning £35,000 (US$44,000) more than £450 (US$564) per year.

However, Labour’s economy spokeswoman Rachel Reeves blasted the move, arguing that the cut “will not remotely compensate” for taxation hikes imposed under 13 years of Conservative rule.

“The British people … know that what has been announced today owes more to the cynicism of a party desperate to cling onto power than the real priorities,” she said.

“The fact is that taxes at this election will be higher than they were at the last. This is the legacy of the Conservatives.”

In a further bid to ease the cost-of-living crisis, Hunt unveiled a series of changes to benefit payments, housing allowances and state pensions, while freezing alcohol duty.

And he confirmed a tax break for businesses, which are currently able to cut tax bills when investing in new equipment, would be made permanent.

Economic activity has been sapped by a stubborn cost-of-living squeeze and a series of 14 interest rate hikes from the Bank of England, which sought to tame inflation but this in turn ramped up the cost of loans for businesses and consumers.

Former UK PM David Cameron returns to government, Braverman out

Former UK PM David Cameron returns to government, Braverman out

Hunt acknowledged on Wednesday that the Office for Budget Responsibility (OBR) fiscal watchdog has ripped up its economic forecast for 2024, when a general election is likely due, and declared increasing productivity was key.

Economic output is forecast to grow by just 0.7 per cent next year, which was sharply down from previous guidance for a solid 1.8 per cent expansion. However, GDP will expand by 0.6 per cent this year, up from the prior forecast for a contraction of 0.2 per cent.

“If we want those numbers to be higher, we need higher productivity,” Hunt said.

The chancellor also hiked the UK minimum wage and lowered the minimum age at which it becomes payable, in a wage boost for 3 million low-paid workers.

Inflation slowed sharply to a two-year low of 4.6 per cent in October in a sign the cost-of-living crisis is easing, yet the rate is still the highest of the G7 world’s richest nations.

Food inflation meanwhile remains in double digits, while households and businesses continue to pay high energy bills after the government scrapped last year’s costly subsidies.

In further gloom, the OBR predicted that inflation would not fall to the Bank of England’s official 2 per cent target until the second quarter of 2025. That is one year later than previously forecast and raises the prospect that interest rates will stay higher for longer.

The BoE’s key interest rate currently stands at a 15-year high of 5.25 per cent.

[ad_2]

Source link