BRC Asia H2 profit rises 11% to S$55 million on sale of associate

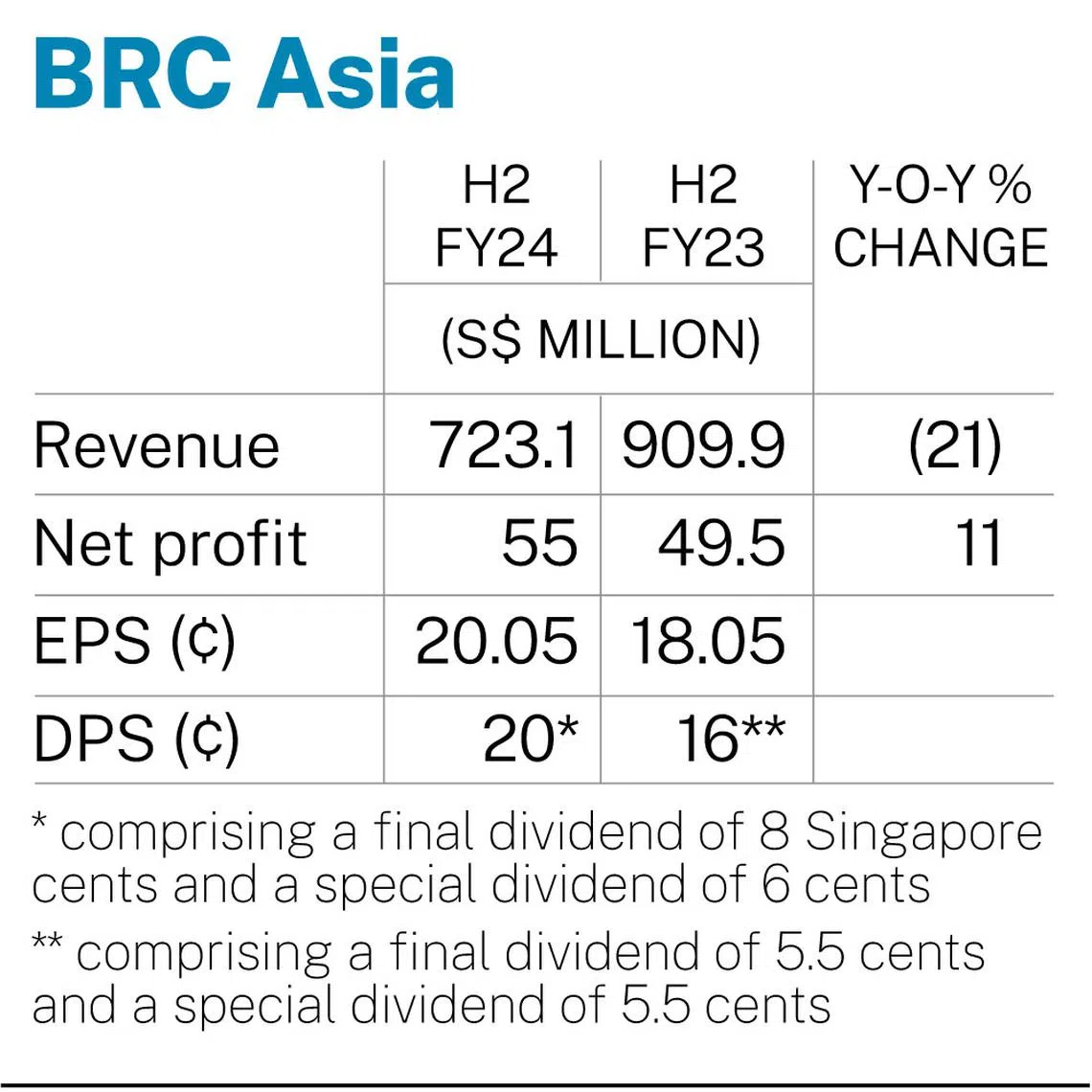

STEEL solutions provider BRC Asia posted an 11 per cent rise in net profit to S$55 million for its second half ended Sep 30, 2024, from S$49.5 million in the same period a year earlier.

Earnings per share stood at 20.05 Singapore cents for the half-year period, up from 18.05 cents the previous year.

Revenue for H2 fell 21 per cent to S$723.1 million from S$909.9 million. This was mainly due to softening demand in the international trading business, coupled with lower steel prices for both the international trading business and domestic construction industry, said the company.

But other income rose 88 per cent to S$20.3 million, from S$10.8 million, due to the disposal of the group’s interest in Pristine Islands Investment, an investment holding company with a 100 per cent interest in a subsidiary that operates and manages an airport, hotel and resort in the Maldives.

The group disposed the investment in H2 2024 and recorded a net gain of S$16.5 million.

For the full year ended Sep 30, 2024, net profit grew 23 per cent to S$93.5 million, while revenue fell 9 per cent to S$1.5 billion.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The dividends proposed in H2 FY2024 bring the total dividend for FY2024 to 20 cents per share. The books closure date and payment date will be announced later.

As at Sep 30, 2024, the group’s sales order book stood at S$1.4 billion, though it cautioned that the “duration of projects in our sales order book range up to five years and may be subject to further changes”.

BRC Asia expects a steady pipeline of projects to be launched and awarded, particularly from the public sector. Yet project off-take from ongoing projects remain “generally disappointing” over the last year.

Shares of BRC Asia closed S$0.02 or 0.8 per cent higher at S$2.39 on Thursday, before the results were announced.