Iran’s PMI shows contraction in economic activities for fifth month in a row

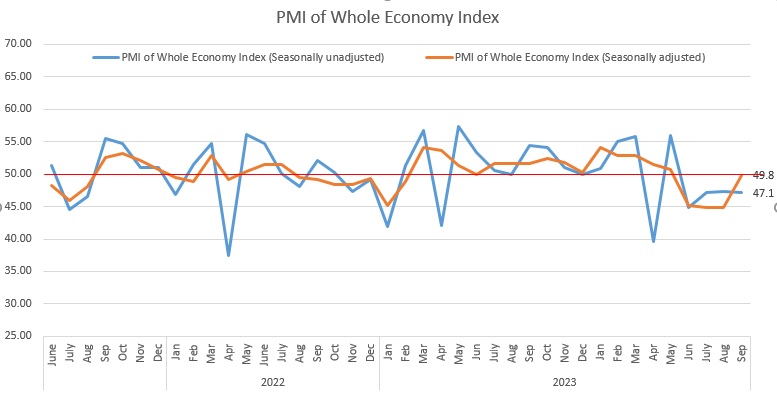

Iran Chamber of Commerce, Industries, Mines, and Agriculture (ICCIMA) has released the country’s new PMI data for the fiscal month of Shahrivar (August 22 – September 21, 2024) which indicates contraction in economic activities for a fifth consecutive month.

The seasonally adjusted PMI was reported at 47.1, declining at a sharpest rate in comparison to 47.4 of the preceding month.

The decline in the index has been owing to multiple indicators, including electricity outages, failure to allocate foreign currency to imports of raw materials and fluctuations in feed prices.

The Statistics and Economic Analysis Center of Iran Chamber of Commerce, Industries, Mines and Agriculture, the sponsor and coordinator of the survey, announces the whole economy PMI data in a report every month.

The headline PMI is a number from 0 to 100, such that over 50 shows an expansion of the economy when compared with the previous month. A PMI reading under 50 indicates contraction and a reading of 50 implies no change.

PMI is an index of the prevailing direction of economic trends, aiming to provide information about business conditions to company directors, analysts and purchasing managers.

Click on the image for better view

The “business activities” sub-index was reported at 46.0 which is below the 50 mark that separates growth from contraction, for a sixth consecutive month although declining at a slower rate compared to 43.4 of the preceding month.

The “new orders” sub-index (43.1) was also below the 50 mark for a fifth month in a row, registering its second lowest in 20 months. Actually, the lack of liquidity on the demand side has led to a continued decrease in orders.

Foreign demand was also reported under 50 for a fifth consecutive month so that the “exports of goods and services” sub-index settled at 48.6 in the month under review.

The “raw material inventory” sub-index (46.5) registered its lowest in three months. The decline happened while the companies are facing problems in meeting their needs for raw materials due to non-allocation of foreign currency, and fluctuations in the prices of raw materials and shortage of liquidity.

The “raw materials price” sub-index was reported at 73.2 in this month, growing at a faster rate in comparison to that of the preceding month. The increase in the raw material inflation posted its biggest in 11 months.

The “employment” sub-index slightly improved to settle at 51.1 after it had declined over the past three months.

|

INDEX

|

Tir1403 (June-July2024)

|

Mordad1403 (July-Aug2024)

|

Shahrivar1403 (Aug-Sep2024)

|

|

PMI (seasonally adjusted)

|

47.2

|

47.4

|

47.1

|

|

business activities

|

45.2

|

43.4

|

46.0

|

|

new orders

|

44.3

|

46.9

|

43.1

|

|

suppliers’ delivery time

|

52.8

|

52.2

|

52.2

|

|

raw material inventory

|

49.7

|

50.8

|

46.5

|

|

employment

|

48.9

|

47.7

|

51.1

|

|

raw materials price

|

69.0

|

70.5

|

73.2

|

|

finished goods inventory

|

54.1

|

50.6

|

49.5

|

|

exports of goods and services

|

48.7

|

46.8

|

48.6

|

|

price of goods and services

|

55.3

|

58.1

|

59.1

|

|

consumption of energy carriers

|

56.1

|

52.3

|

53.3

|

|

sales of goods and services

|

48.9

|

46.9

|

45.3

|

|

expectations for next month economic activities

|

59.3

|

60.3

|

61.8

|