China’s never-ending bond bull run fuels speculation regulators may intervene

OVER the past year, China’s bond market has witnessed a surge in trading activities, driven primarily by an influx of funds into long-term government bonds.

The central bank has repeatedly issued warnings, and some large banks have come under investigation for selling long-term bonds and making illegal transactions, leading to speculation that regulators might intervene in the bond investments of financial institutions.

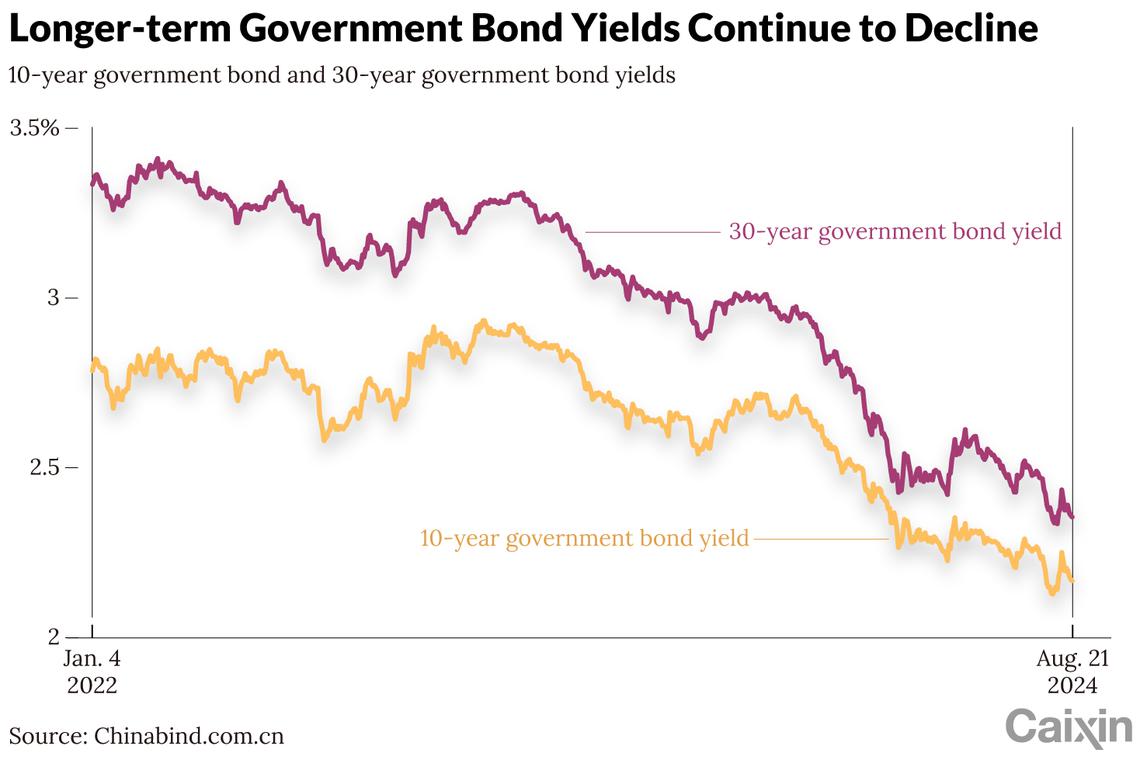

Since the start of 2024, the yield on 10-year government bonds has fallen by more than 40 basis points, while the yield on 30-year bonds dropped by over 50 basis points. By early August, bond prices had hit record highs.

Experts warn that continuous market trends – whether rising or falling – inevitably lead to the accumulation of risk, which can trigger a reversal when external shocks occur, such as the redemption wave of China’s wealth-management products in 2022.

The rapid drop in long-term government bond yields is a key concern for the central bank, said Xu Zhong, deputy secretary-general of the National Association of Financial Market Institutional Investors (NAFMII), a self-regulatory body in the interbank market.

The goal is to prevent the accumulation of systemic risks in the bond market, especially as bond prices have surged amid falling yields, he said.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Industry experts say the central bank is unlikely to interfere directly with financial institutions’ investment decisions. Instead, the warnings serve to caution against over-aggressive investment practices.

Nevertheless, some banks have overreacted by halting bond trading entirely, displaying poor risk management and misinterpreting the central bank’s warnings, they said.

Funds pouring into bonds

On Aug 5, long-term government bond yields reached record lows, with the 10-year bond yield falling below 2.1 per cent and the 30-year bond yield dropping below 2.3 per cent. This drop followed two interest rate cuts in July, which reduced the seven-day reverse repo rate and the loan market quote rate by 10 basis points, and the medium-term lending facility rate by 20 basis points.

The steep decline in bond yields reflects both the falling yields across all credit grades and the increased preference among investors for long-term bonds due to their leverage effect. Market expectations of upcoming US Federal Reserve rate cuts, coupled with China’s loosening monetary constraints, encouraged preemptive trading.

Experts attribute the rapid yield decline not only to macroeconomic imbalances but to strategic market manipulation by certain financial institutions. Some have engaged in prohibited trading activities to profit from price movements, contributing to the bond market’s volatility.

On the supply side, weak loan demand and lower loan interest rates have led banks to seek alternative investments, with long-term bonds becoming an attractive option, several bankers told Caixin.

However, the slow issuance of national and local government bonds in the first half has created a supply-demand imbalance, further driving down yields, they said.

Speculative trading by smaller financial institutions as well as individual investors has also played a role, with some treating bonds like stocks, leading to inflated demand and risk accumulation, a financial market researcher at a large state-owned bank said.

A growing concern is the reliance of small and medium-sized banks on bond-trading profits, with some deriving more than half of their income from these trades. This dependence has raised questions about their ability to manage interest rate risks effectively, especially in the volatile bond market.

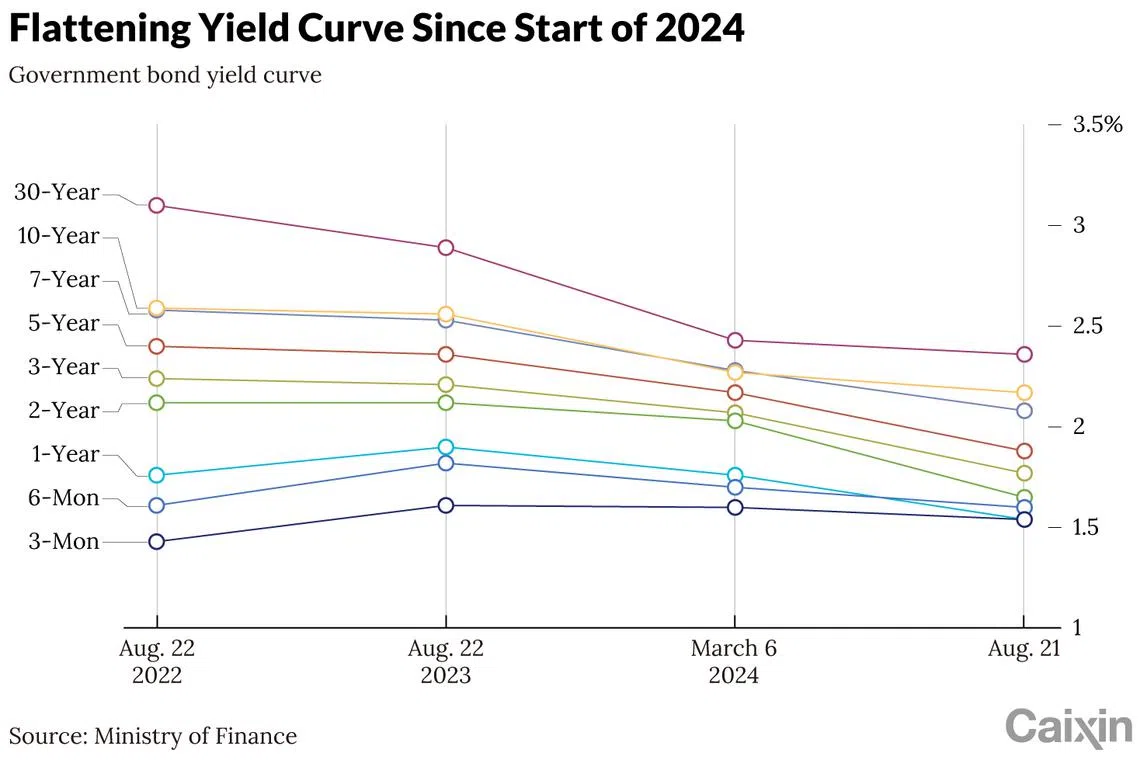

Due to the larger decline in long-term bond yields and the narrowing of the term spread of short and long-term bonds, the yield curve of Chinese government bonds has flattened considerably. In June, central bank governor Pan Gongsheng stressed the importance of maintaining a normal upward-sloping yield curve to incentivise investment.

As bond yields corrected in late July, investors speculated on the central bank’s acceptable range for long-term bond yields. In its second-quarter monetary policy report released in late June, the central bank said the 10-year bond yield had reached a 20-year low of 2.2 per cent, falling below what is considered a reasonable range.

Analysts at BOC International said in a report that a 10-year yield below 2.2 per cent might be unsustainable, with the central bank preferring yields to stay between 2.2 and 2.3 per cent.

Xu stressed that while the central bank is monitoring the risks associated with falling bond yields, particularly regarding market expectations and the financial stability of banks, it has not set an explicit target for long-term bond yields.

Central bank’s warnings

In recent months, the central bank on the one hand has warned repeatedly against the rapid fall in long-term bond yields, while on the other cutting reserve ratios and interest rates to stimulate the real economy. Xu said these moves were complementary rather than contradictory.

The central bank’s objective is to create a stable monetary environment for economic growth while preventing systemic risks in the bond market caused by fast-falling yields, he said.

Since April, the central bank has issued several risk warnings as long-term bond yields dropped sharply. On Apr 3, it first cautioned about changes in long-term yields. Later, it suggested it could intervene in the government bond market to stabilise yields.

In July, it escalated its actions, conducting debt-borrowing operations with market dealers to control yields. In August, it reiterated warnings about the risks tied to asset management products that rely heavily on bond investments.

Under current market conditions, some financial institutions, especially smaller and riskier players, have been overly aggressive, Xu said.

Without adequate risk management, these institutions could face significant balance sheet impacts if market expectations reverse. He drew comparisons to the 2023 collapse of Silicon Valley Bank in the US.

The divergence in strategies between large and small banks has also become more apparent. Large banks have focused on lending, while smaller institutions – especially rural and urban commercial banks – have aggressively bought bonds, hoping to increase their income through trading.

In June, urban commercial banks traded more than nine trillion yuan (S$1.65 trillion) in bonds, while rural commercial banks accounted for 7.5 trillion yuan in bond transactions.

The bond market’s bull run has also driven demand for asset management products such as bond financing and bond funds. However, the central bank has warned that these products could face significant risks if the bond market reverses, potentially leading to mass redemptions and collapsing prices.

The correlation between falling bond prices and the declining net value of asset management products could trigger panic among investors, leading to a downward spiral, as seen in 2022 after new asset management regulations were introduced. As bond prices fall and net values decline, large-scale redemptions of such products could further destabilise the market, experts warned.

Rural financial institutions are particularly at risk. Experts argue that they should focus on serving the rural economy through credit delivery rather than speculative bond trading. Given their weaker capital positions, rural banks face greater exposure to bond investment risks and may struggle if yields rise.

The central bank has already begun conducting stress tests on the exposure of financial institutions to bond assets to mitigate interest rate risks. These tests aim to assess how vulnerable institutions are to bond market fluctuations and whether they have sufficient capital reserves to cover potential losses.

Crackdown on misconduct

In recent months, the regulators have intensified their crackdown on illegal activities in the government bond secondary market.

Four rural commercial banks in East China’s Jiangsu province are suspected of manipulating market prices and illegally transferring profits when trading government bonds on the secondary market, according to a notice released on Aug 7 by the NAFMII.

NAFMII found violations by small and midsize financial institutions trading government bonds, including the lending of trading accounts and illegally transferring profits.

Looking forward, NAFMII plans to work closely with the People’s Bank of China to enhance regulatory oversight in the interbank bond market. It will introduce new rules for market participants, particularly brokers and dealers, to ensure compliance in key trading areas.

This will include stricter business inspections, sanctions for violators and cooperation with regulatory and law enforcement bodies to crack down on illegal interest transmission cases. CAIXIN GLOBAL