Southern European Economies set to outperform euro area this year: QNB

The Global Financial Crisis that ignited in 2007 marked the beginning of a prolonged period of economic under-performance for the SEE , which comprise Spain, Greece, Italy, and Portugal.

The significant fiscal and structural challenges faced by the SEE (among others, escalating sovereign debt, rigid labour markets, and over-indebted private sectors), had made these countries particularly vulnerable to large negative shocks, QNB said in an economic commentary.

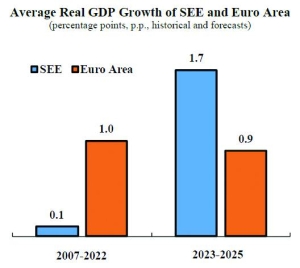

Over the period of 2007-2022 that includes the major disruptions caused by the Global Financial Crisis (GFC), the Sovereign Debt Crisis (SDC) and the Covid-pandemic, real GDP of the SEE grew on average at a rate of 0.1% per year, almost 1 percentage point (pp) less than the 1% annual growth rate of the Euro Area as a whole.

After the Covid-pandemic, the SEE finally embarked on a path of relative recovery on the back of cyclical and structural factors.

Over the period 2023-2025, real GDP growth is expected to average 1.7%, almost double the 0.9% of the euro area.

In this article, QNB discusses three key reasons that explain why the SEE’s growth performance has improved.

First, the end of the Covid-pandemic sparked a boom in tourism that provided a boost to the SEE, where this sector has a large overall impact on the economy. As the pandemic receded and travel restrictions were lifted, tourism rebounded strongly and began a sustained period of expansion. Various measures of the numbers of visitors, total revenues, and hotel occupancy are growing at rates of 15%-20% across the SEE. This implies a significant boost to the SEE, where the estimates of the total direct and indirect weight of tourism in GDP vary from 8 to 20%.

Similarly, the weight in total employment is substantial. With a labour force of 25mn, Italy has 4.5mn workers in tourism-related sectors, while in Spain, 2.7mn of the 24mn workers are engaged in these industries.

In addition to consumption by tourists, the spending of tourism workers and firms acts as a multiplier in the rest of the economy. Thus, the post-pandemic “revenge” spending on tourism is having a major positive impact on the SEE through both direct and indirect channels.

Second, compared to the most manufacturing-intensive economies in the Euro Area, the SEE has benefited from a relative improvement in its competitiveness after the GFC and SDC, as well as from a better insulation from the energy crisis due to the Russo-Ukrainian war.

The SEE were less reliant on gas imports from Russia, relative to the more energy-intensive countries in the euro area, namely Germany, Austria, and Slovakia (the GAS countries), making the SEE less exposed to energy shortages and price increases. Additionally, the GFC and SDC triggered major adjustments in labour markets in the SEE, which put downward pressure on wages and therefore a decline in relative labour costs.

Unemployment rates across the SEE increased on average by 13.3 percentage points from the pre-crises lows to their peaks. These massive adjustments led to a reduction in wage pressures and the labour costs for firms.

As a result, unit labour costs show a significant divergence between the SEE and the GAS since the onset of the GFC: they have increased on average by 34% in the SEE, compared to 62% for the GAS countries, QNB noted.

The effects of the energy crisis and competitiveness have become evident in manufacturing: Between Q2,2023 to Q2,2024 average industrial production expanded by 1% in the SEE, while contracting by 4.1% in the GAS economies.

The relative gain in competitiveness and lower exposure to the energy crisis have given manufacturing in the SEE an advantage relative to the most manufacturing-intensive European neighbours.

Third, the deleveraging process in the private sector and the improvement of sovereign debt sustainability reduce financial instability fears and restore investor confidence.

Since the crises, households and firms in the SEE have deleveraged at an impressive pace: the average ratio of private sector credit to GDP in the SEE has fallen by 65pp from its peak of 134% in 2011 to the current levels of 69%.

The adjustment efforts by governments have also been significant, even if smaller, considering the large fiscal expansions that were necessary during the Covid-pandemic: average gross debt in the SEE dropped by 14 p.p. from 139% of GDP in 2014 to 125% this year.

These improvements have allowed for higher rates of private investment, a key component of GDP from an expenditure perspective: between Q1, 2023 and Q1, 2024, average investment spending in the SEE expanded by 2.2%, while it contracted by 0.6% in the Euro Area. Thus, the correction of financial imbalances have improved the conditions for investment and growth in the SEE.

“All in all, the SEE are set to outperform again this year with expected average real GDP growth of 1.6%, compared to 0.8% for the Euro Area, on the back of a boom in tourism, improved relative competitiveness, as well as the correction of financial imbalances,” QNB added.