QIIB bags STP Excellence Award from Commerzbank Frankfurt

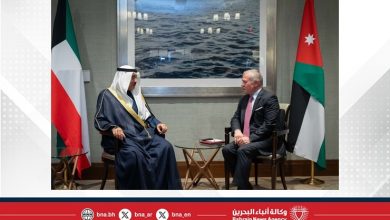

Mohammed Khair Barhoumeh, Chief Operations Officer at QIIB, receives the award from Georges Bou Nemar, Representative and Relationship Manager at Commerzbank Frankfurt, during a ceremony held at the bank’s headquarters.

The event was attended by Syed Asim Mahmoud, head of Operations at QIIB, and Badr Abou Assali, director, Structured Solutions at Commerzbank.

Mohammed Khair Barhoumeh, chief operations officer at QIIB, received the award from Georges Bou Nemar, Representative and Relationship Manager at Commerzbank Frankfurt, during a ceremony held at the bank’s headquarters.

The event was attended by Syed Asim Mahmoud, head of Operations at QIIB, and Badr Abou Assali, director, Structured Solutions at Commerzbank.

Commerzbank Frankfurt awarded QIIB for its outstanding performance in international payments STP, and its ability to meet the highest globally recognised standards OF STP.

This results in an efficient and less costly payment process.

Commenting on the award, Barhoumeh said, “We thank Commerzbank Frankfurt for presenting us this award. In fact, we are pleased to see that our meticulous work in international payments has been recognised. Our early investment in technological solutions in this field has proven successful, as most payments are now reaching their destinations directly without manual interference.”

“Our reliance on advanced technological solutions supports us in our various operations, particularly in payments, where we have been able to significantly improve efficiency and reduce costs, in line with the plans and strategies set by QIIB’s management.”

Barhoumeh pointed out: “QIIB places great importance on staying current with various technological developments and emerging trends in payments. We also provide regular training for our staff on new Swift updates/products, through trainings, workshops and webinars, and this is reflected in our performance.

QIIB has made significant strides in digital transformation, with most of its operations now conducted using cutting-edge technology and various digital channels.

This progress has strengthened the bank’s leadership, contributed to the expansion of its customer base, and increased demand for its various banking services and products.