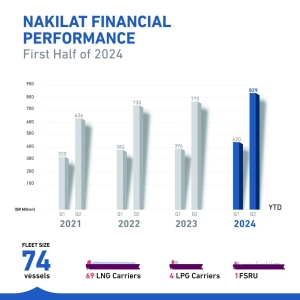

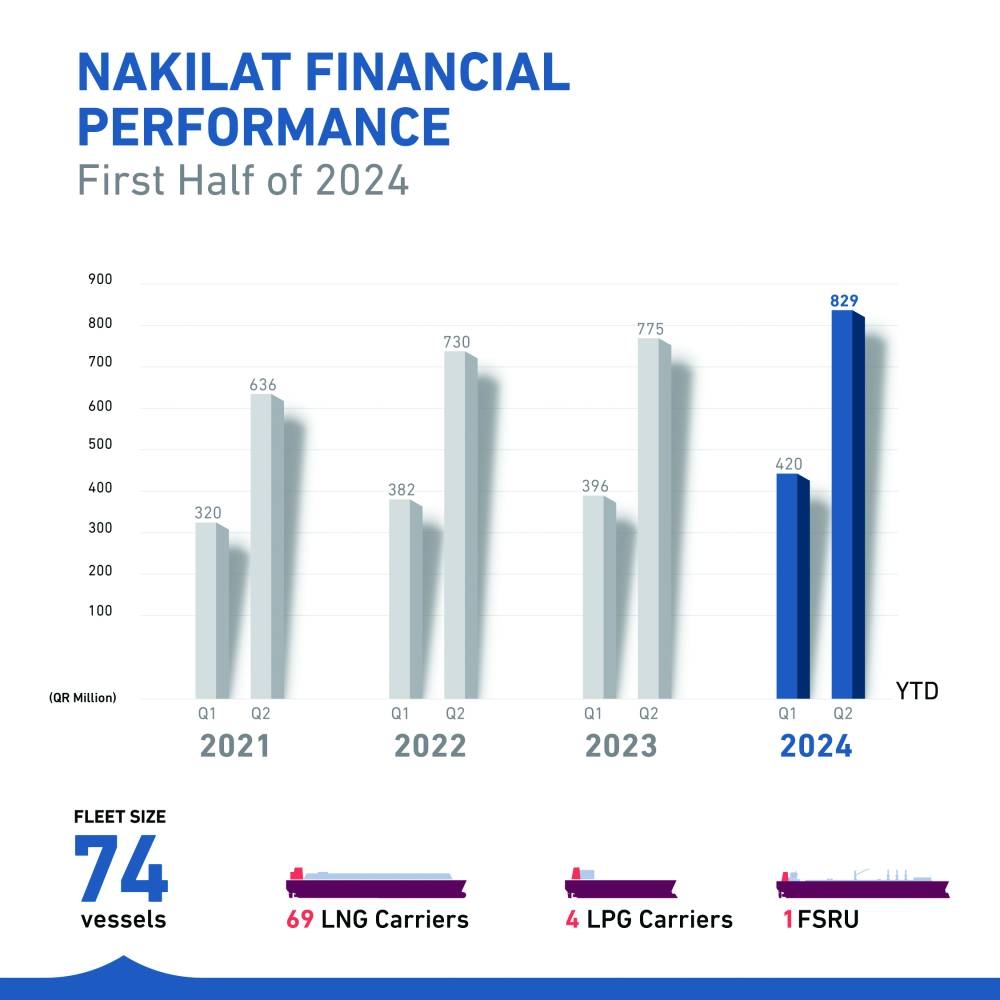

Nakilat achieves QR829mn net profit in January-June

This robust financial performance highlights Nakilat’s resilience and its strategic capabilities in dealing with the dynamic economic landscape.

“2024 is a milestone year for Nakilat’s expansion projects, and our latest financial result, with an increase in net profit by 7%, is a testament to the company’s two decades of global operational excellence in maritime services,” said Abdullah al-Sulaiti, Nakilat’s chief executive officer.

The company reported a 4% year-on-year reduction in total expenses to QR1.46bn at the end of June 30, 2024.

In 2024, Nakilat achieved significant milestones in its fleet expansion project, signing contracts to build six advanced gas carriers, including two LNG (liquefied natural gas) carriers and four modern LPG/ammonia carriers.

Nakilat also entered long-term contracts with QatarEnergy to charter and operate nine QC-Max LNG carriers, each with a capacity of 271,000 cubic metres, in addition to 25 conventional LNG carriers, each with a capacity of 174,000 cubic metres.

These new vessels will be constructed and delivered according to the scheduled timeline over the coming years. This initiative reflects Nakilat’s commitment to modernisation and innovation in maritime transport services, aiming to meet the growing demand in the global energy shipping sector.

Upon completion of these vessels, Nakilat’s fleet will reach a total of 114 ships, reinforcing its global leadership in the clean energy transport sector.

The board has decided to convene an extraordinary general assembly meeting on August 28 to review its proposals regarding the distribution of interim cash dividends at a rate QR0.07 per share, and to approve the amendment of Articles of Association.

The interim dividends will be granted to shareholders who own shares at the end of the trading session on the day of the extraordinary general assembly meeting that approves this distribution.