Hong Kong IPO: China’s Black Sesame raises US$133 million in tough market conditions

Mainland Chinese car chip designer Black Sesame International Holding has become Hong Kong’s fifth-largest listing of the year after pricing its initial public offering (IPO) at the low end of the marketed range.

The IPO, the second such listing under the city’s newly relaxed rules for specialist technology firms – Chapter 18C, has been priced at HK$28 per share, the bottom end of the HK$28 to HK$30.3 range, according to people familiar with the matter.

The firm raised HK$1.04 billion (US$133 million) from the sale of 37 million shares, surpassing QuantumPharm’s HK$989.3 million IPO, the first listing under Chapter 18C in June.

Retail investors oversubscribed Black Sesame’s offer without triggering the clawback mechanism under the listing rule, the sources said, who did not want to be identified for discussing a private matter. One of the sources said the public tranche’s oversubscription level was about two to three times, below the 10 times threshold that would have triggered the reallocation of shares.

The split between the international tranche and the Hong Kong public offering is expected to remain at 95 per cent and 5 per cent, respectively.

Retail orders were withdrawn during the IPO period after seeing star US tech stocks fall collectively, according to a source involved in the deal.

“Setting the price at a lower level is suitable for both the company and investors amid the current challenging market sentiment,” said Kenny Wen, head of investment strategy at KGI Asia in Hong Kong. Unwinding of carry trades and worries about a US recession will pressure the new shares, he added.

Tea shop giant Sichuan Baicha Baidao Industrial’s HK$2.58 billion IPO in April has been Hong Kong’s biggest fundraising so far this year, followed by Cirrus Aircraft’s HK$1.51 billion offering in July, RoboSense Technology’s HK$1.06 billion share sale in January, and ride-hailing service provider Chenqi Technology’s HK$1.05 billion IPO in July.

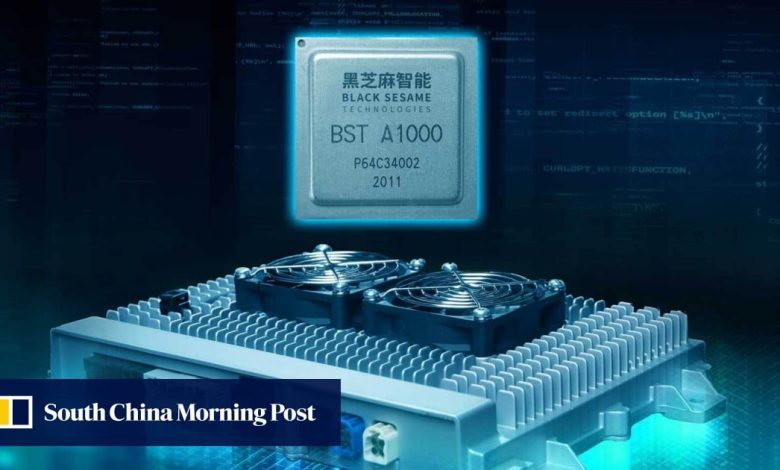

Black Sesame, based in Wuhan, capital of central Hubei province, is a chip designer focused on autonomous driving systems. It is considered one of the mainland’s top firms that can compete with the likes of US rivals Nvidia and Qualcomm.

The company’s revenue nearly doubled year on year to 312.4 million yuan (US$43.71 million) in 2023. However, losses widened to 4.86 billion yuan from the previous year and are expected to continue this year because of substantial anticipated expenses on research and development.

Hong Kong’s Chapter 18C, introduced in 2023, allows companies with at least HK$10 billion in valuation to sell shares in Hong Kong even if they have yet to earn a single dollar in sales. For companies with at least HK$250 million in sales in the financial year before their IPO, the minimum valuation is HK$6 billion.

Black Sesame falls into the latter category. According to its prospectus, its expected market capitalisation at the time of listing, based on the HK$28 offer price, is HK$15.94 billion.

The company will announce the results of the allotments and the IPO’s formal pricing on Wednesday. The listing under stock code 2533 will follow on Thursday.

Bonuses for new players

Bonuses for new players