Big Tech trade shudders just as stock pickers make a comeback

An earnings flop from Tesla Inc and fears about Alphabet Inc spending landed just as popular bets in bonds and commodities misfired, adding to the cross-asset disruptions. Yet for all noise, one trend is unmissable: Unloved fringes of the equity landscape – from small caps to banks – are suddenly on a tear and stock picking is back in vogue.

With the so-called Magnificent Seven accounting for a historic share of this year’s equity rally, the blind love affair with capitalisation-weighted indexes appears to be on shaky ground. Retail and institutional investors are looking to diversify into new market winners by sinking cash into everything from consumer stocks to health care – regardless of the sorry track record for anyone trying to beat the tech-driven market.

“Big Tech valuations are very stretched, raising the risk of AI disappointment,” said Michael O’Rourke, chief market strategist at JonesTrading. “This will be a good time for stock pickers as the corrections and consolidation of the mega caps will create opportunities elsewhere.”

July’s wild ride underscores how betting on seven large tech companies is no longer a simple, slam-dunk trade, and their sheer heft has been weighing on indexes in recent sessions. As a result, investors have jumped into other corners of the market as concerns about a potential downturn dissipate.

While the S&P 500 tumbled 0.8% this week, more than 300 of its members ended the week with gains. The Russell 2000, which tracks small caps, scored its third week of wins and outperformed the benchmark by the most in 24 years in July. The biggest Russell 2000 ETF posted inflows at the second-fastest monthly pace on record.

The rotation into small caps is supported by economic data, the thinking goes. The latest GDP report highlighted the resilience of American consumers and businesses. The Federal Reserve’s preferred gauge of inflation published on Friday rose at a tame pace, cementing expectations for an interest-rate cut in September.

All that is giving succour to investors betting on market laggards to catch up. As investors look for opportunities beyond tech, all but one of 10 equity ETF sectors have seen inflows in July for the first time since 2022.

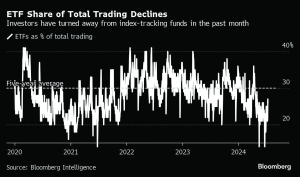

At the same time the trading volume represented by equity ETFs recently fell to as low as 14% of all exchange volume, below the five-year 30% average. That implies investors are preferring to trade individual stocks over broader indexes, according to Bloomberg Intelligence’s Athanasios Psarofagis.

Stock picking has fallen out of favour for more than a decade, as index-tracking funds performed better at much lower costs. Nowadays though, active managers — in theory — should be thriving given low correlations between equities. An S&P 500 gauge tracking their co-movements has been hovering around decade lows. It’s a sign that companies are trading on the basis of their own business fundamentals, like the outlook for profits.

Yet with only a handful of megacaps names gobbling up gains for most of this year, active managers haven’t managed to win big despite the benign theory.

“Outperforming through stock picking when market returns are so dominated by such a small number of huge firms is essentially impossible,” said James Athey, a portfolio manager at Marlborough. “I do not believe that Big Tech can or will dominate ‘forever’ and thus, in the end, stock pickers will once again have their day.”

Going forward then, the big question is whether tech companies — whose earnings are supposedly less tethered to the business cycle — will be able to reprise their role as safety trades like they did in the pandemic slowdown. The bar is higher in this cycle with high valuations for the biggest winners and an already outsized investor positioning in these names heading into an expected economic cooling.

“We have seen over the past weeks that passive investors are exposed to that concentration risk,” Jeff Schulze, head of economic and market strategy at ClearBridge Investments, said in an interview. “But in the next six months, when we see a step down in the growth rates of the US economy, investors will go back to what was working — the perceived safety trade, which is the largest companies in the S&P 500, the Magnificent Seven, the more tech, more growth-oriented companies that are well tied to this AI theme.”