Bondholders ‘strongly oppose’ Chinese developer Sino-Ocean’s debt-revamp plan

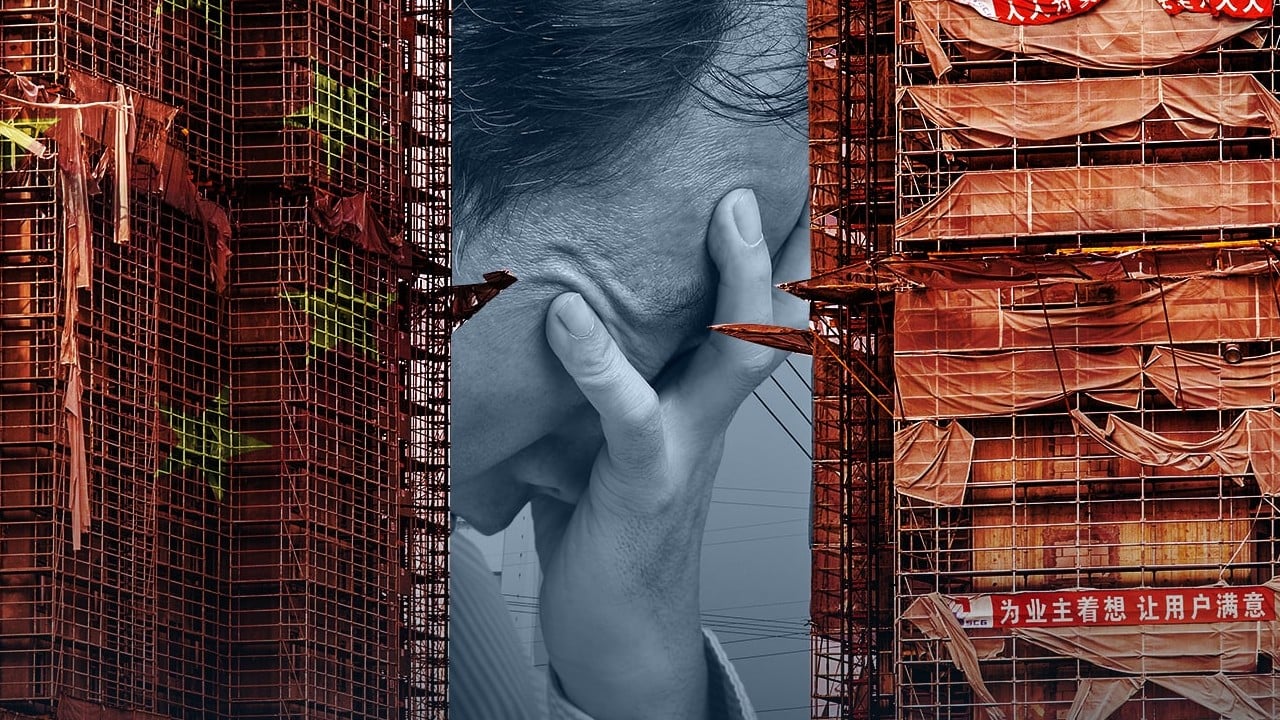

Embattled Chinese developer Sino-Ocean Group faces the risk of liquidation amid challenges to secure enough consent votes on a restructuring proposal, as a key bondholder group is “strongly opposed” to it.

Linklaters, the legal adviser for an ad hoc group of bondholders, organised a meeting on Wednesday to advocate a veto of the developer’s proposal, asking creditors not to sign the restructuring support agreement (RSA), the Post has learned. The ad hoc group constitutes more than 25 per cent of the notes guaranteed by Sino-Ocean, Linklaters told the meeting.

The law firm told creditors that the commercial terms were “not appropriate”, referring to a lack of financial support from China Life Insurance, the biggest shareholder of Sino-Ocean and “unfair” asset allocation to offshore creditors, according to a memo of the meeting seen by the Post.

Linklaters also warned that a liquidation analysis of the company to estimate creditors’ recovery is not complete and some details crucial to ensure the implementation of the company’s plan are missing.

It added that the current proposal was very “prejudicial” to bondholders, and the ad hoc group “strongly opposes” the plan. More than 60 per cent of bondholders oppose the RSA, the memo showed.

Linklater did not reply to an emailed request for comment.

The meeting came within a week of Sino-Ocean announcing its initial restructuring plan. The proposal, which aims to restructure US$5.6 billion of existing debt, provides creditors options such as US$2.2 billion of new debt linked to offshore assets, or exchanging debt into mandatory convertible bonds or new perpetual securities, according to an exchange filing last Thursday.

There are four classes of creditors and all bondholders are grouped into three of these, according to the proposal. Bondholders, which account for some 55 per cent of the amount, are the biggest creditor group of the debt.

The principal terms of the proposal have been agreed by a group of members representing around 50 per cent of the aggregate principal amount of the debt dubbed “class A”, the Beijing-based developer said in the filing.

Sino-Ocean, one of the many Chinese developers that have defaulted on dollar bonds amid a liquidity crisis, has suspended payments on offshore borrowings since September 2023.

The company last month received a liquidation petition in Hong Kong filed by the Bank of New York Mellon’s London branch for US$400 million in debt and accrued interest. The first hearing is scheduled on September 11.

Sino-Ocean said in a separate filing last week that though the petition “does not represent the interests of other stakeholders and may impair the value” of the company, any uncertainty on progressing its restructuring would add to risks of a winding-up liquidation, pointing out that it is required to submit evidence to fight the petition on or before August 21.