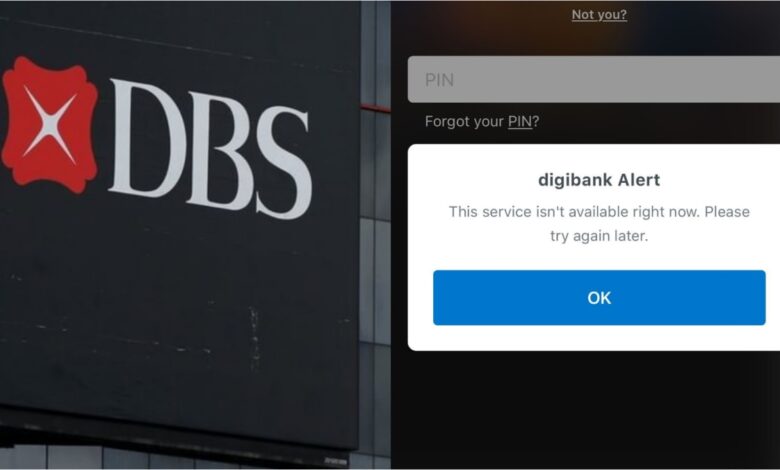

DBS internet banking services down for some users

On Tuesday, the Monetary Authority of Singapore (MAS) said that it would not seek to extend the six-month pause on non-essential activities that it imposed on DBS after the bank’s multiple service disruptions in 2023.

MAS added that it will retain the multiplier of 1.8 times for DBS’ risk-weighted assets for operational risk until the bank “has demonstrated the ability to maintain service availability and reliability, and handle any disruptions effectively”.

The penalty was imposed in May 2023, up from the 1.5 times that was implemented in February 2022.

The authority noted on Tuesday that DBS has since made “substantive progress” to address the shortcomings identified from the service disruptions last year, even as efforts to implement its remediation plan are ongoing.

MAS said it would closely monitor the bank’s progress and the effectiveness of the measures.

“In the event of service disruptions, MAS expects DBS to promptly recover its services and communicate to its customers in a clear and timely manner,” it said.

DBS said on Tuesday that being able to resume its activities “will not dilute its focus on strengthening technology resiliency and enhancing digital service availability”.