Boeing burn through almost $4bn in Q1

Boeing, which is grappling with multiple crises currently, reported an adjusted loss per share of $1.13, and revenue of $16.57bn in the first three months, according to a statement on Wednesday. Boeing, which didn’t provide earnings guidance for the year, rose as much as 4.6% in New York after the results, for its biggest intraday gain since January 31.

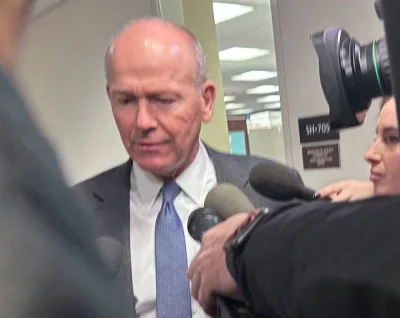

Boeing’s first three months of the year have been overshadowed by the fallout from the near-catastrophic Alaska Airlines accident on January 5 that’s upended the company’s manufacturing, financials and management. Chief Executive Officer Dave Calhoun, who plans to step down by the end of the year, told employees in a memo that Boeing is “leaving no stone unturned” as it reworks its factories, encourages workers to point out defects and slows its system to identify faults in its processes.

Boeing faces investigations by aviation regulators and the US Justice Department. Though no one was killed, the explosive loss of cabin pressure injured some on board and recalled the two fatal crashes that led to the worldwide grounding of the Max for nearly two years.

A preliminary report by the National Transportation Safety Board found that four bolts meant to fasten the panel to the fuselage were missing. A US Federal Aviation Administration audit of Boeing found “multiple instances” where it allegedly failed to meet manufacturing and quality control requirements. Regulators have given the company until the end of May to submit a plan to improve.

Boeing said on Wednesday it was “implementing a comprehensive action plan” to address the audit’s findings.

“Near term, yes, we are in a tough moment,” Calhoun said in the memo. “Lower deliveries can be difficult for our customers and for our financials. But safety and quality must and will come above all else.”

During the quarter, the Boeing 737 MAX programme slowed production below 38 a month, Boeing said. Boeing ended the reporting period with $7.5bn in cash and short-term securities, down from $16bn at the start of the year. The company said it still has access to $10bn in undrawn credit. Boeing had already cautioned a few weeks ago that it would suffer a cash outflow of as much as $4.5bn in the quarter. By that measure, the earnings release offered a respite at a time when little has gone Boeing’s way.

The company has been hit by a leadership exodus, civil and criminal investigations, Congressional hearings and whistle-blower revelations. Its 737 factory has slowed to a crawl as the planemaker cuts down on out-of-sequence work and drafts a 90-day plan to bolster its quality and safety for US regulators.

Boeing’s recovery hinges in no small part on input from the Federal Aviation Administration, which has tightened oversight of the company in the wake of the accident. Measures include a capped output of the 737, and inspectors on the ground at Boeing factories reviewing manufacturing.

As of Tuesday, shares of Boeing had lost more than a third in value since the start of the year, the worst performer on the Dow Jones Industrial Average. Rival Airbus SE, which reports earnings on Thursday, had gained 18% in the period.

The manufacturer is being squeezed by reduced revenue and the rising cost of keeping its suppliers afloat until its production system can smoothly handle higher manufacturing rates again.

Boeing plans to build 737s at a very slow pace during the first six months of 2024, then accelerate to its previous 38-jet monthly rate later in the year, Chief Financial Officer Brian West said last month. As of March 1, it shifted inspections of the narrowbody frames to Wichita, Kansas, where they are built by supplier Spirit AeroSystems Holdings Inc.

Fuselage shipments have fallen as a result, adding to Spirit’s own financial challenges. Boeing is providing a $425mn funding infusion, which Spirit is to repay over the next six months, the aerostructures supplier announced in a filing after the close of trading Tuesday.

Boeing has been the subject of 32 whistle-blower complaints with the workplace safety regulator in the United States during the past three years, newly obtained documents reveal, amid mounting scrutiny of standards at the beleaguered aircraft maker.

The figures shed light on the extent of alleged retaliation by Boeing against whistle-blowers as the Virginia-based company is facing mounting questions over its safety record and standards.

The Occupational Safety and Health Administration (OSHA), which handles claims of retaliation against workers who blow the whistle on their employer, received the complaints of retaliation between December 2020 and March of this year, according to a table of figures compiled last month by officials at the agency.