Qatar banks make sizeable gains in overall deposits driven by public and private sectors: QNBFS

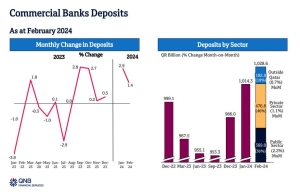

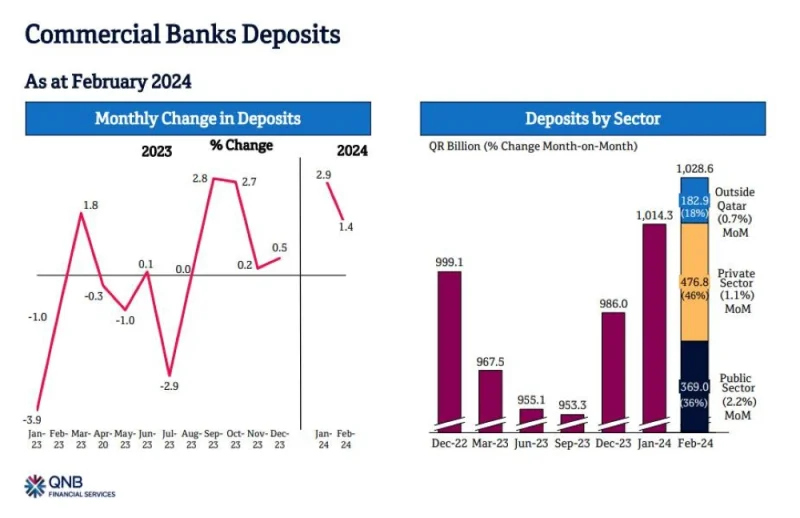

Qatar banking sector deposits increased 1.4% during February to reach QR1,028.6bn, driven by both the public and private sectors, according to QNB Financial Services

Deposits growth in February was mainly due to an increase by 2.2% in the public sector and 1.1% in the private sector

Deposits grew by an average 4.1% over the past five years (2019-2023), QNBFS said in its ‘Qatar monthly key banking indicators’.

The overall loan book went down 0.5% in February to QR1,312.9bn.

The loans decline in February was mainly due to a drop by 0.4% in the private sector and 0.7% in the public sector.

Loans increased by 1.9% in 2024, compared to a growth of 2.5% in 2023. Loans grew by an average 6.5% over the past five years (2019-2023)

Loan provisions to gross loans stood at 3.8% in February and 4% in January, QNBFS said.

Total assets edged down by 0.2% during February to QR1.97tn.

The total assets loss in February was mainly due to a slide by 0.4% in domestic assets.

Total assets was marginally higher in 2024, compared to a growth of 3.4% in 2023. Assets grew by an average 6.8% over the past five years (2019-2023)

Liquid assets to total assets was at 30.6% both in February and January 2024, QNBFS said.

In terms of overall deposits, the government institutions’ segment (represents 55% of public sector deposits) went up by 2.3% MoM (+5.6% in 2024), while the semi-government institutions’ segment rose by 5.1% MoM (+1.6% in 2024).

The government segment (represents 30% of public sector deposits) moved up by 0.7% MoM (+15.2% in 2024) in February.

Private sector deposits expanded 1.1% MoM (+2.7% in 2024) in February. On the private sector front, the consumer segment increased by 1.2% MoM (+3.4% in 2024), while the companies and institutions’ segment gained by 0.9% MoM (+1.9% in 2024).

Non-resident deposits added 0.7% MoM (+2.1% in 2024) in February.

The overall loan book went down 0.5% in February 2024. Total private sector loans moved lower by 0.4% MoM (+0.5% in 2024). Consumption and others, general trade and real estate were the main drivers for the private sector loan drop.

Consumption and others (contributes 21% to private sector loans) fell 1.5% MoM (+0.3% in 2024), while general trade (contributes 21% to private sector loans) moved down 0.5% MoM (+1% in 2024), and the real estate segment (contributes 20% to private sector loans) slid 0.4% MoM (+0.4% in 2024).

However, the services (contributes 32% to private sector loans) moved up 0.6% MoM (+1% in 2024) in February.

Outside Qatar loans edged down by 0.2% MoM (-1.1% in 2024) during February.

Total public sector loans contracted 0.7% MoM (+5.7% in 2024) in February 2024. The government segment (represents 31% of public sector loans) was the main catalyst for the public sector with a drop by 3.2% MoM (+12.3% in 2024).

However, the semi-government institutions’ gained 4.2% MoM (+4.8% in 2024) and the government institutions’ segment (represents 63% of public sector loans) rose marginally MoM (+2.8% in 2024).

Qatar banking sector’s loan provisions to gross loans was at 3.8% in February, compared to 4% in January, QNBFS noted.

An analyst told Gulf Times: “The banking sector continued to make sizeable gains in overall deposits, with both the public and private sector gaining by 2.2% and 1.1%, respectively. The public sector was pushed higher mainly by government institutions and semi-government institutions, while the private sector was lifted up by both the personal and companies and institutions”.