Chocolate prices could soar as changing climate patterns worsen cocoa crisis | Business News

This Easter, chocolate lovers will no doubt have noticed they had to pay more for their eggs.

Now, the cost of chocolate could soar after changing climate patterns hit cocoa supplies in west Africa.

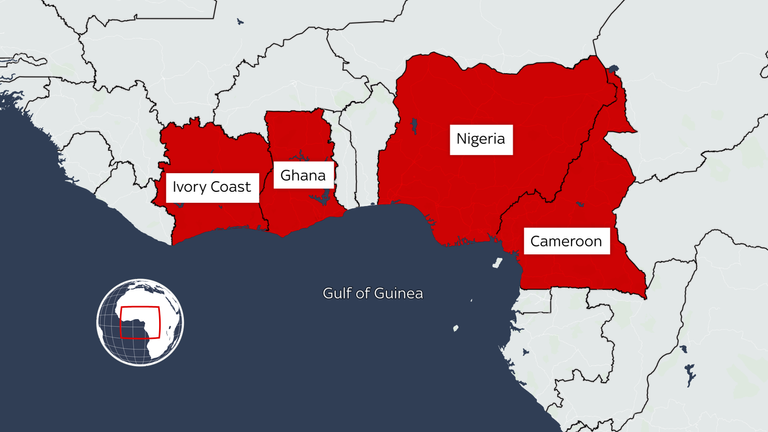

Seasonal dusty winds from the Sahara have been severe in recent months, blocking out the sunlight needed for cocoa bean pods to grow in Ghana, the Ivory Coast, Nigeria and Cameroon – where around three-quarters of the world’s cocoa is produced.

In the previous season, heavy rainfall spread a rotting disease among the cacao trees, which produce cocoa, the main ingredient in chocolate.

Chocolate makers have already increased prices for consumers after three years of poor harvests, with Which? saying some Easter eggs and bunnies cost around 50% more this year, while others have shrunk in size.

The global price of cocoa has risen sharply as exports from the Ivory Coast, the world’s largest producer, fell by a third in recent months.

The price has already doubled this year, trading at a record high of more than $10,000 (£7,920) per metric ton of cocoa in New York on Tuesday.

But farmers who harvest cocoa beans have raised concerns the increases are not enough to cover their higher production costs and lower yields, which many blame on climate change.

Cacao trees only grow close to the equator and are particularly sensitive to changes in the weather.

Farmers harvest cocoa from the trees, which they sell to local dealers or processing plants. They turn the beans into butter, powder and liquor that can be made into chocolate and sell the products to global chocolate companies.

Cocoa is traded on a regulated global market, with prices set up to a year in advance.

Read more from Sky News:

Do not eat a whole Easter egg in one go, NHS doctor urges

Energy bills projected to fall by less than expected this summer and autumn

Drivers are still paying over the odds for fuel, competition watchdog fears

System breaks down in times of shortage

However, in times of shortage the system breaks down, with local dealers paying farmers a premium price to secure beans.

As global traders then rush to purchase those beans at any price to meet their obligations with the global chocolate firms, local processors are often left short of beans.

Plants forced to stop or cut processing

Several major African cocoa plants in Ivory Coast and Ghana have been forced to stop or cut processing because they are not getting the cocoa they pre-ordered and cannot afford to buy beans at the higher prices, Reuters reported earlier this month.

The International Cocoa Organisation (ICCO) said the mismatch between supply and demand will leave the market with a deficit of 374,000 tons this season, up from 74,000 last season.

As a result processors and chocolate firms will have to draw on cocoa stocks to fully cover their needs and the ICCO said it expects cocoa stocks to fall to their lowest in 45 years by the end of the season.