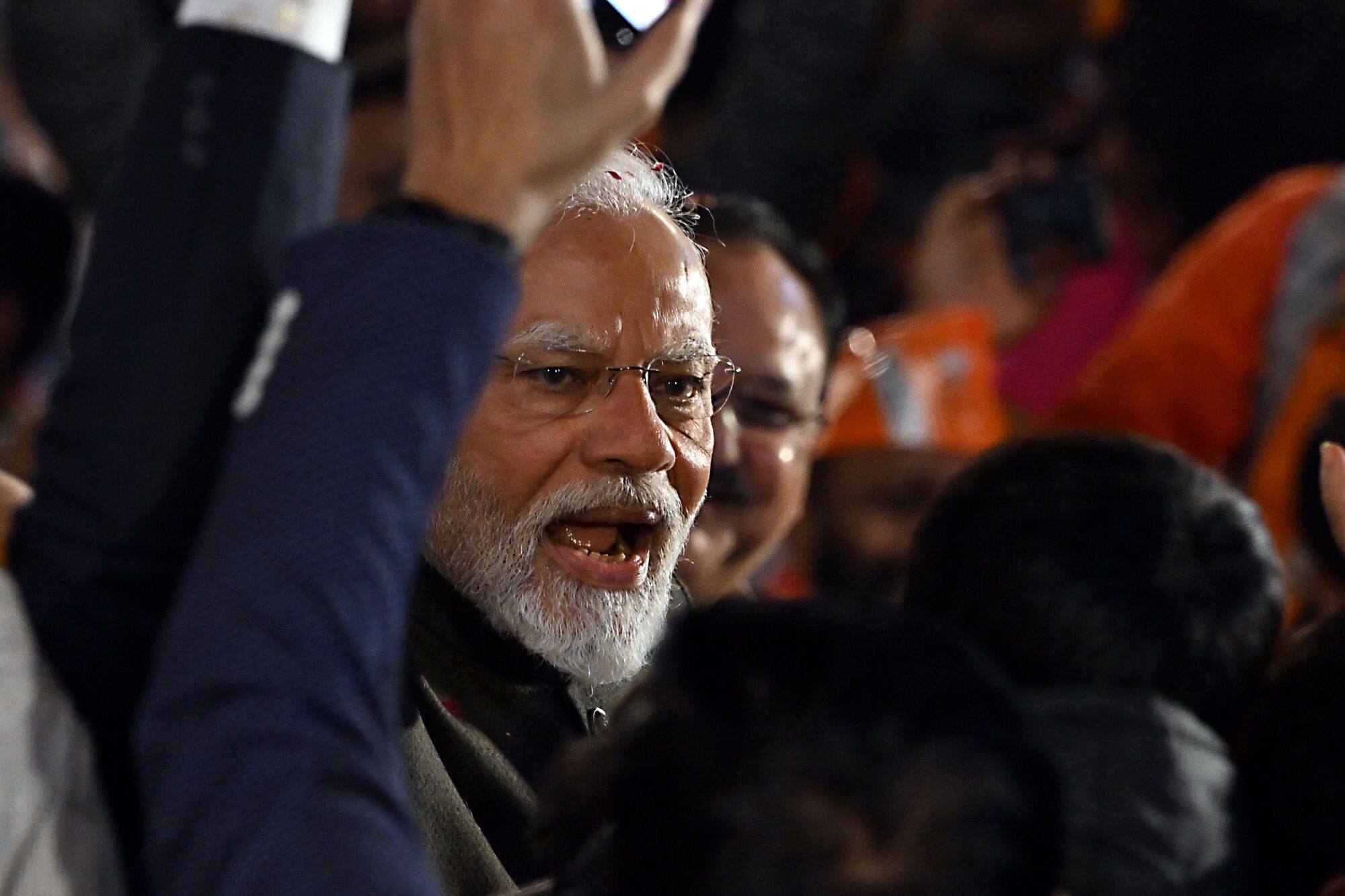

India’s stocks rally as Narendra Modi’s BJP nears election win, but can bull run continue?

[ad_1]

After a brief bout of profit-booking earlier this week to cash in on the rally, the index resumed its upward march on Thursday. Both the Sensex and Nifty were marginally up on Thursday morning at 71,668.68 points and 21,602.35 points, respectively.

“Once the state elections results were out, the base case for continuity of the government has strengthened,” said Mihir Vora, chief investment officer at Trust Mutual Fund, underscoring that the government’s record of policies like production-linked incentives for manufacturing and infrastructure development had fuelled the positive sentiment.

‘Much easier’: QR codes power rural India into a cashless economy

‘Much easier’: QR codes power rural India into a cashless economy

The government’s reputation for governance had also been embellished by programmes such as expanding digital payments to remote communities, he said. But he warned that many younger investors would be ill-prepared to cope with any shock poll results.

“The average age of investors was 40 and now it is 29. More than 50 per cent to 60 per cent of investors have not seen drawdowns on a sustained basis and that is a cause for worry,” Vora said, referring to the remote possibility of erosion in stock values for more than a year.

Indian stock markets are expected to be volatile around the elections, which are tentatively scheduled from April to May in the world’s largest democracy.

Vulnerable to shocks

“There would be a lot of news flows and that would play with investor sentiment,” said Sneha Poddar, associate vice-president at Motilal Oswal Financial Services Limited. “People have got a little cautious at these [market] levels. They are aware that there are risks.”

India’s opposition parties have strung together an alliance called the Indian National Developmental Inclusive Alliance – commonly known as INDIA – in an attempt to halt the BJP’s victory march. But its prospects appear slim as it has not arrived at a seat-sharing arrangement to field a common candidate that avoids undercutting each constituent party’s votes.

Besides domestic politics, Poddar said there were global uncertainties lurking for investors, such as whether the US Federal Reserve would deliver on its hint of cutting interest rates this year. Such a move by the world’s largest economy is likely to prompt other central banks, including the Reserve Bank of India, to loosen up on tight lending.

If the Federal Reserve did cut rates, it should boost Indian stock markets because foreign institutional investors were likely to chase higher returns in the country, Poddar said.

In India, Modi’s party stirs up Hindu nationalism with temple at disputed site

In India, Modi’s party stirs up Hindu nationalism with temple at disputed site

The bull run in secondary stock markets has rubbed off on primary markets to raise funds through public share offers.

Twenty-seven companies have approvals and another 36 are awaiting clearances from India’s stock market regulator, the Securities and Exchange Board of India, to launch public share offers, says Prime Database group, a leading Indian provider of data on capital markets.

Several initial public offerings are expected to be launched over the next couple of months before the market pauses on account of the elections, according to Pranav Haldea, managing director of Prime Database.

The Indian market has been among the earliest to rally since countries began opening up their borders in the aftermath of the Covid-19 pandemic, bolstering a growth streak. It remained resilient through 2023, amid weak global macros, rising interest rates and geopolitical uncertainties. The Sensex and Nifty clocked eight successive years of positive returns and surged around 20 per cent last year.

In contrast, Hong Kong’s benchmark Hang Sang index fell 14 per cent last year, declining for four consecutive years with a slowdown on China’s economic growth weighing on sentiment.

With a cooling off of inflation over the past few months, India’s economy has performed better than expected, giving a boost to corporate earnings growth.

On Wednesday, India Ratings and Research revised higher India’s GDP growth in the financial year 2023-24 to 6.7 per cent from 6.2 per cent, citing sustained government expenditure as one of the factors.

Deven Choksey, founder of wealth management firm K.R. Choksey, said the government’s programme of building infrastructure such as roads, ports and renewable energy generation was a key factor behind the stock rally because such projects offered long-term certainty to investors.

“We are giving project clarity for the next 10 years. Stock markets are benefiting because of that. Every rupee you add to the economy, which is adding to the GDP which will get reflected in market capitalisation,” he said.

[ad_2]

Source link