Former senior Chinese official urges foreign investors to return, says trade remains ‘ballast’ of US-China ties

[ad_1]

Building on those official contacts, three US-China working groups – on economic, financial and commercial issues – have also begun to carry out dialogues in an apparent effort to set the stage for a Biden-Xi summit.

Bi said the frequent interactions were a “positive factor” for moving forward bilateral economic ties.

He, China’s top economic and financial policy official, will meet US Treasury Secretary Janet Yellen during his five-day trip, which comes amid tensions over tech curbs and subsidies.

At the trade show, the US Soybean Export Council and global food corporation Cargill signed purchase agreements with Chinese state-owned enterprises, while the US Grains Council signed a cooperation agreement with state-run firms.

This followed the recent signing of 11 purchase agreements worth billions of dollars between a delegation of Chinese commodity importers and top US merchants including ADM, Bunge, and Cargill during the US-China Sustainable Agricultural Trade Forum in Des Moines, Iowa last month. These deals to purchase soybeans, corn, sorghum, and wheat were the first bulk agreements signed since 2017.

On Monday, US ambassador to Beijing Nicholas Burns said his country wanted more trade with China rather than decoupling.

Last week, Burns said agriculture served as the “ballast” in the US-China relationship when addressing a conference on farm trade cooperation in Beijing.

Two-way trade between the two economic powerhouses fell 13 per cent from a year ago to US$550.8 billion in the first 10 months of the year, according to Chinese customs data.

In the same time frame, the US trade deficit with Beijing narrowed by 20 per cent, driven by a decrease in exports from China.

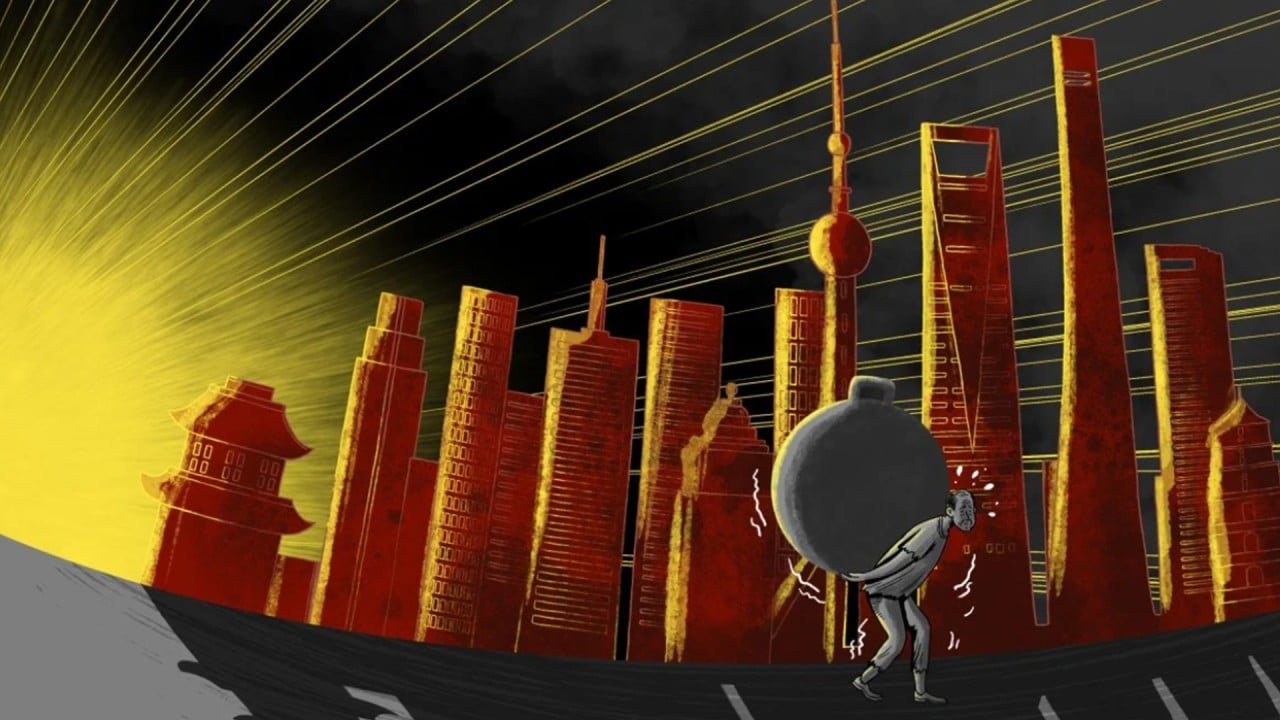

In balance-of-payments terms, China recorded a US$11.8 billion deficit in foreign direct investment during the July-September period, the first-ever quarterly net outflow, according to the latest data from the State Administration of Foreign Exchange.

Bi said this dynamic was “normal” as “capital always moves towards places with the lowest costs and highest profits”.

“I hope that the gentlemen and ladies who have left China, especially those who left during the pandemic, will go back to China to take a look,” he said.

“China remains a good place for investment and employment opportunities for all countries.”

When asked about China’s post-Covid recovery, Bi said the economy did face some challenges such as the real estate sector and local government debt.

However, he said there was a lot of demand in the Chinese market that had not yet been met and outlined several areas where more inputs were needed.

For example, large-scale investment in urban underground pipe networks, which was a focus of China’s 1 trillion yuan (US$137.4 billion) sovereign debt plan approved last month, could help consume overstocked steel and cement, he said.

By raising nursing fees, the country could create tens of millions of new job opportunities for nurses, Bi added.

From 2015 to 2018, Bi served as head of the China Food and Drug Administration, where he pushed for higher transparency in the country’s medical sector.

After the office was merged into the State Administration for Market Regulation in March 2018, he became the Communist Party head of the new ministerial-level agency.

At the forum, Bi stated that addressing the housing needs of migrant workers in cities, developing the elder care industry and opening more joint educational ventures with foreign entities could all benefit the economy.

“We can achieve a lot [if] we liberate our thinking in those areas. The potential for China’s economic growth is huge,” he said.

[ad_2]

Source link