Opinion: By blaming China for its trade deficit, EU is barking up the wrong tree

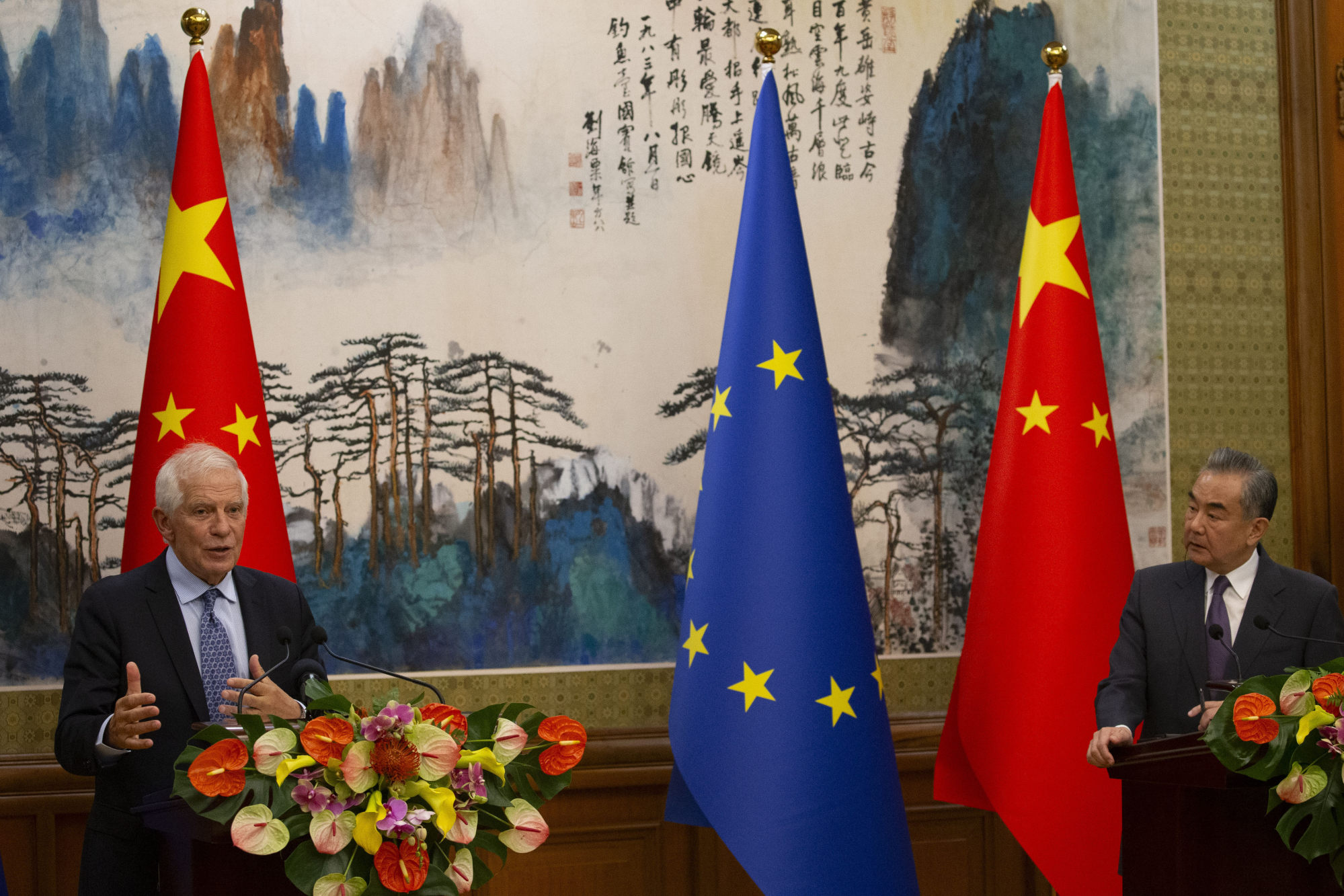

Brussels attributes this “trade imbalance” to the lack of access to China’s market. EU trade commissioner Valdis Dombrovskis criticised China’s level of openness as not being “the same as the level of openness from the EU side”. Meanwhile, the bloc’s chief diplomat Josep Borrell said China’s trade surplus with Europe had more to do with poor market access than productivity issues or a greater competitive advantage.

While the EU’s concern over its massive trade deficit is understandable, it is overlooking the fundamental causes.

The fact is, China’s trade surplus is the result of the interplay of market forces. It is, first of all, partially due to the country’s manufacturing prowess. This is true not just of Europe, but also the rest of the world.

One need look no further than at US-China bilateral trade to be convinced of the competitiveness of China’s export machine. Despite an average US tariff rate on Chinese goods of around 20 per cent, China’s trade with the US broke a record in 2022. Its trade surplus in 2022 was also a record high, according to Chinese customs data.

Second, China’s trade surplus may also have to do with the EU’s weakened competitiveness, relatively speaking. From the pre-pandemic year of 2019 to 2022, while the rest of the world exported 35 per cent more goods to China, according to Ministry of Commerce data, the EU’s exports to the country increased by a mere 3.2 per cent.

As a result, the EU’s share of China’s imports fell to 10.5 per cent from 13.3 per cent, down by 2.8 percentage points. Since no restrictive measures targeting the EU were taken by China during that period, the EU’s shrinking market share probably indicates a loss of international competitiveness.

In response to the EU’s grievances, China has recently agreed to ramp up work on improving market access for cosmetics, infant milk formula and some other products the EU wants to get to China. These measures will boost EU exports to China, but they can only do so much. The trade imbalance cannot be improved significantly without addressing some of the key factors behind the deficit.

Currently, the EU’s drive to get more goods and services into China is hampered by its own stringent export control regime. The bloc maintains an extensive list of dual-use goods and technologies that need approvals before they can be shipped to China. Many products and technologies on the list have a ready market in China, and they are where the EU enjoys a competitive edge.

The EU’s export control regime has therefore worked to dent the crown jewels of its export sector, hitting exports to China. Yet Brussels has not even acknowledged that this is a contributing factor to its trade imbalance.

Indeed, it could well be the EU’s geopolitical plays and budding trade protectionism that will largely determine the contours of its trade with China.

In focusing on China, Europe risks missing true ‘de-risking’ dangers

In focusing on China, Europe risks missing true ‘de-risking’ dangers

Moves like these would stoke trade conflicts, frustrating the EU’s effort to get more goods into China. In an editorial on the probe, the Financial Times said, “Resorting to protectionist measures is not in Brussels’ long-term interests.”

Clearly, by ascribing its trade deficit with China to poor market access, the EU is barking up the wrong tree. To address the trade imbalance, it needs to shift its focus to the root cause, and tackle the problem head on – by improving productivity, depoliticising economic and commercial issues, and refraining from resorting to trade protectionism.

Zhou Xiaoming is a senior fellow at the Centre for China and Globalisation in Beijing and a former deputy representative of China’s Permanent Mission to the United Nations Office in Geneva