Kenya to seek US$1b from China for stalled railway, ‘more time’ to repay debts, deputy president says

[ad_1]

Kenya currently has about US$8 billion in Chinese loans, most of it used by the administration of Ruto’s predecessor Uhuru Kenyatta to build the Mombasa-Nairobi Standard Gauge Railway (SGR) and highways. Seeking more funding from China would be a shift in stance for Ruto’s apparently West-leaning team, which has criticised the previous administration for burdening the country with Chinese debt.

After bashing China loans, Kenya’s president signals reverse course

After bashing China loans, Kenya’s president signals reverse course

Chinese state-owned Export-Import Bank advanced some US$5 billion about a decade ago for the SGR’s 590km (367 mile) track from the Indian Ocean city of Mombasa – East Africa’s largest port – through the capital Nairobi to Naivasha, about 80km to Nairobi’s northwest.

The 472km Phase 1 to Nairobi was completed in 2017, with an 120km extension to Naivasha coming two years later.

But a planned further extension from Naivasha to Malaba, on the border with Uganda, was stalled after China Exim Bank refused to provide further funding without a commercial viability study.

Leading a delegation to Beijing late last month, Murkomen spoke of hopes “to complete our ongoing road projects, extend the railway to Malaba, dual our main highways, expand our port and airports’ infrastructure, equip our technical and vocational Institutions, build water dams and implement our smart and intelligent traffic systems” in partnership with China.

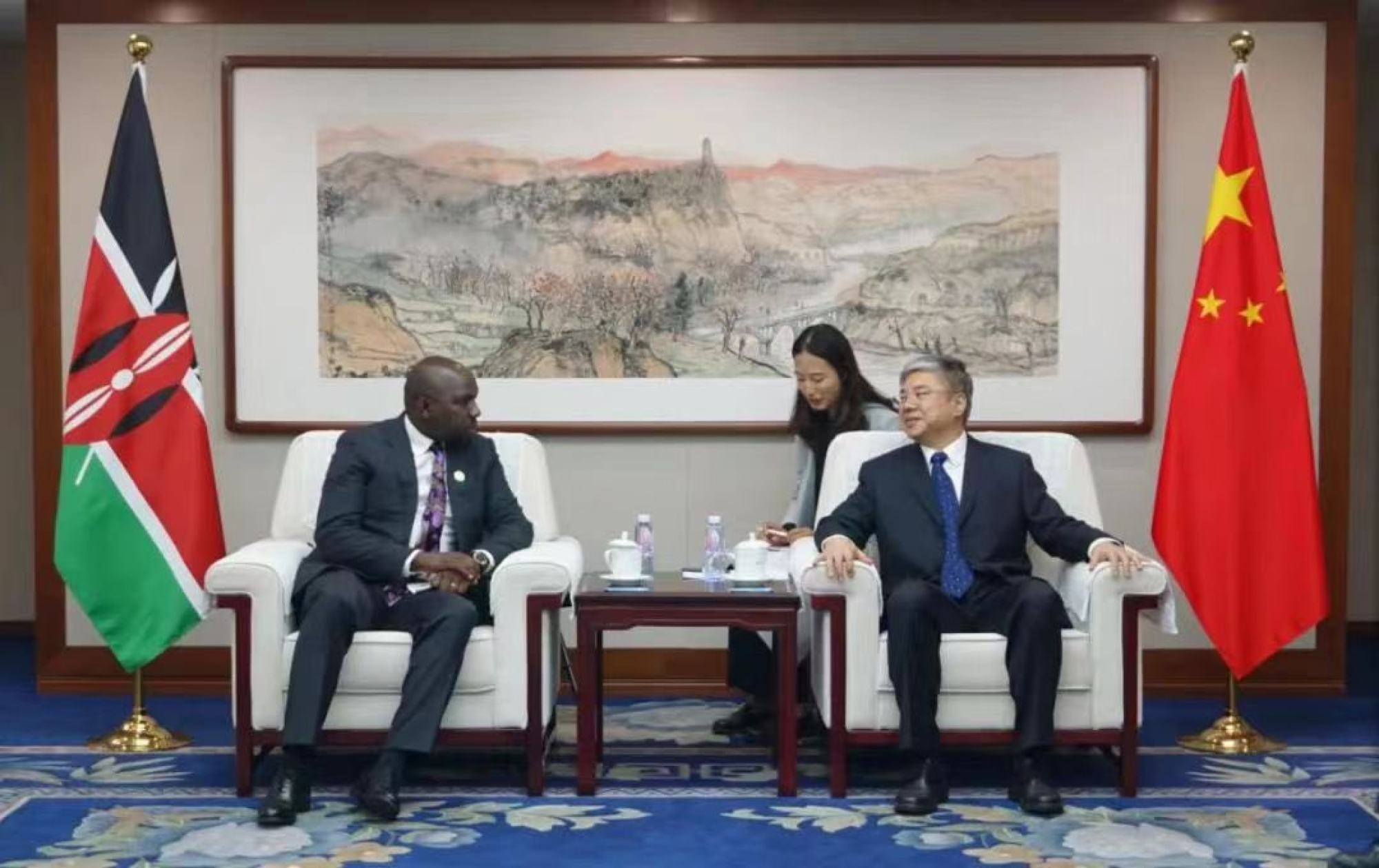

In Beijing, Murkomen held talks with his Chinese counterpart Li Xiaopeng, and officials from the Chinese foreign ministry, the China International Development Cooperation Agency (CIDCA) and policy lender China Development Bank.

This came two months after Chinese Foreign Minister Wang Yi’s visit to Nairobi, where his talks with Ruto included discussions on the financing of Kenyan infrastructure projects.

Tim Zajontz, a research fellow at the Centre for International and Comparative Politics at Stellenbosch University in South Africa, said Chinese financiers and firms appeared to be the first choice to extend the Kenyan SGR, for reasons of path-dependency.

“The Chinese firms that constructed the first two sections of the SGR are already mobilised in Kenya and are involved in the operation of the railway between Mombasa and Naivasha,” Zajontz said. For a private investor, it made little economic sense to build and operate only the outstanding segment of the rail line between Naivasha and the Ugandan border.

Uganda was also left in need of funding to build a railway line from Malaba to the capital Kampala, after China Exim Bank dropped plans to finance the US$2.4 billion section. The landlocked country has since contracted Turkish firm Yapi Merkezi to build the 273km section, with funding expected from Standard Chartered Bank and British export credit agency UK Export Finance.

He said revenues for the Kenyan SGR were expected to increase significantly as soon as Uganda’s cargo markets could be reached seamlessly on an uninterrupted standard gauge line.

“For China Exim Bank, this improves the prospects that Nairobi will be able to digest yet another railway loan. But the matter is not solely a financial one but also one of prestige,” said Zajontz, co-editor of a book on China’s role in Africa’s “railway renaissance”.

“The Chinese government has a keen interest in bringing one of the flagship projects of the Belt and Road Initiative to a successful end after years of controversies.”

Does US embrace mean end of Kenya’s pro-China ‘Look East’ policy?

Does US embrace mean end of Kenya’s pro-China ‘Look East’ policy?

Aly-Khan Satchu, a sub-Saharan Africa geoeconomic analyst, said: “On the plus side, Kenya has been paying its Chinese loans and so far without demur and that’s a plus in Chinese eyes.”

While the Ruto administration, which took office a year ago, had evidently pivoted “a little violently” from East to West, “ultimately, it’s no bad thing to show partners [in the East and West] that Kenya has options. The proof will be in the financing pudding, however”.

As for Uganda, Satchu said its balance sheet was not as aggressively leveraged as Kenya’s, “particularly if you factor in the forward oil story”.

Uganda is expected to start commercial oil production in 2025. “[Therefore] Uganda’s decision to belatedly come to the party is a credit enhancement story for the overall viability of the SGR,” Satchu said.

In July, Kenya and Uganda signed an agreement on the financing and concurrent development of the Naivasha-Kisumu-Malaba and Malaba-Kampala SGR lines in their respective territories.

This is expected to ease the transport of fuel, currently carried by trucks along the Mombasa-Nairobi-Kisumu highway.

[ad_2]

Source link