Chinese billionaires’ bid to trim art collection ends in disappointment at Sotheby’s Hong Kong auction

A high-profile Chinese billionaire couple suffered a setback on Thursday as they began trimming their hoard of art to raise funds amid a downturn in the market, as many of the pieces failed to meet presale estimates or went unsold at a dedicated auction in Hong Kong.

“The Long Journey” sale, named after Liu Yiqian and Wang Wei’s chain of three Long Museums in Shanghai and Chongqing, sold only 28 of the 39 paintings on offer for a total haul of HK$455 million (US$58.1 million) during Sotheby’s annual autumn auction, 24 per cent less than the bottom estimate of HK$597 million excluding fees.

This was the first of three sales of their collection, with two more in London and New York in the coming weeks.

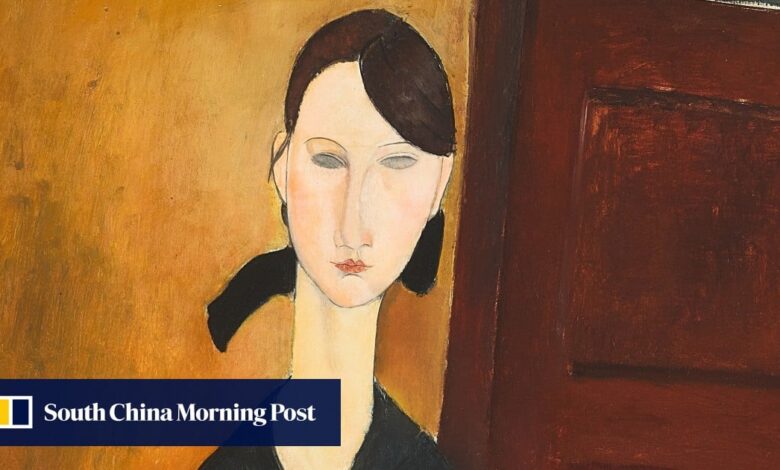

In a packed hall at the Hong Kong Convention and Exhibition Centre in Wan Chai, the top lot – Amedeo Modigliani’s 1919 Paulette Jourdain – went to dealer Patti Wong, bidding for a client, for HK$235 million net of fees, which represented a massive HK$97.2 million loss for Liu and Wang compared with its 2015 purchase price.

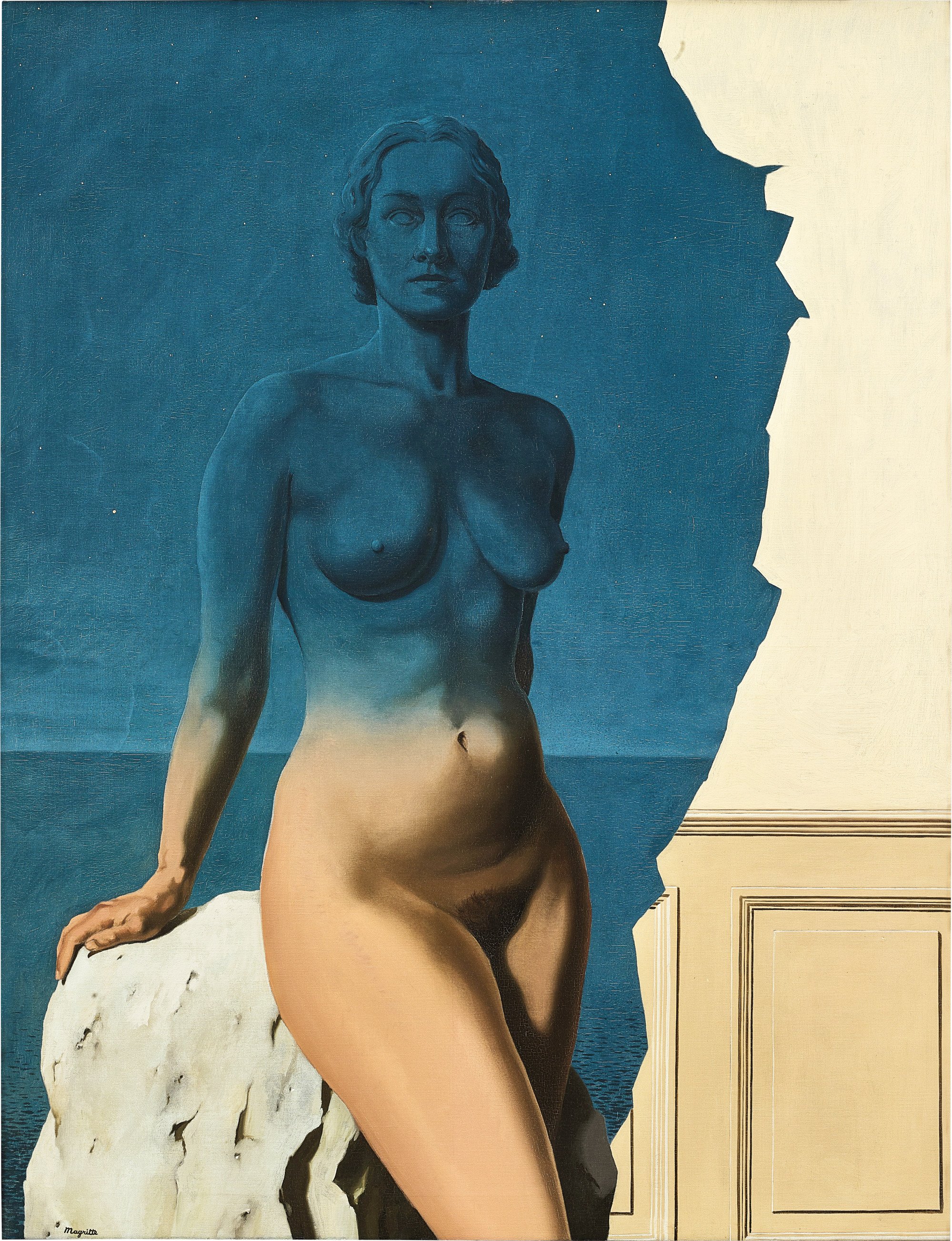

Rene Magritte’s Le Miroir Universel (1939), also bought in 2015 for US$6.7 million (HK$51.7 million), fetched HK$65 million against the presale estimate of HK$70 million, a HK$13.3 million profit for the sellers.

Among the 10 works which did not sell were David Hockney’s A Picture of a Lion, with a low estimate of HK$42 million, which the couple had bought directly from Pace Gallery in New York for an undisclosed price. One 2003 work by Wang Xingwei was withdrawn just before the auction.

The two pieces in the sale which the couple had owned the longest were Ding Yi’s Appearance of Crosses 2007-14 (2007), which was passed, and the late Japanese artist Tetsuya Ishida’s Wild (1999), which sold for HK$3.5 million excluding fees.

They were both bought in 2009 before the couple began their high-profile foray into the high-end Western art market in the mid-2010s.

The sale also raised eyebrows for including works by young international artists that the couple acquired in the past three years from top galleries, which take care to place in-demand “hot” artists with established collections that do not have a track record of “flipping” – buying and selling quickly to make a profit.

“About 25 per cent of the artworks offered have been acquired over the past three years, mostly through top galleries,” said Wu Kejia, art historian and author of A Modern History of China’s Art Market.

“The fact that they are circulating within such a short period of time may be a concern for Western blue-chip galleries.”

In 2014, the Chinese stock market was in the middle of a year-long rally which turned Liu, a former taxi driver born in 1963, into a dollar billionaire through canny investments in the stock market and in companies spanning technology to pharmaceuticals.

According to the Hurun China Rich List 2022, Liu and his family were ranked 131st with an estimated wealth of 37 billion yuan (US$5 billion), up 33 places from the previous year.

It is unclear why the couple, who have not responded to interview requests and, who people close to the matter say, have not been able to attend the Hong Kong auction, opted to sell during a downturn in the art market.

Out of the couple’s three museums, only the one in West Bund, which recently celebrated its 10th anniversary, is currently open. The oldest museum, which opened in Shanghai Pudong in 2012, has not had an exhibition since 2020, according to the official website.

Sotheby’s downplayed the significance of the sale and further sales in New York and London later this year. Earlier, the Art Newspaper reported that another 50 works could be sold in New York, including “a major work from the collection”.

“Like all great collections, this collection should evolve,” said Alex Branczik, senior director of Sotheby’s modern and contemporary art department. “As collectors, their collecting journey will continue.”

“The Long Museum still holds a large number of significant artworks Liu and Wang have collected since the 1990s,” art historian Wu said, adding that the sale may be a “pilot” to test the market’s reception.

“What is offered in this sale is only a very small portion of the museum’s permanent collection.”

Of the two, Liu in particular is known for his eccentricity, as he became one of the very few collectors who publicly announced his acquisitions, a daring move in a notoriously opaque market that cherished anonymity and discretion.

He famously drank tea from a Ming dynasty porcelain cup that he paid US$36 million for in 2014, after swiping his American Express Centurion card 24 times, gathering 422 million reward points in the process.