Opinion | Hong Kong budget: city must continue to resist magic money temptation

[ad_1]

Although Hong Kong’s 2024 budget is many months away, a great deal of preparation has been completed. The first half of each financial year is spent inviting ministers to offer proposals for spending on new and improved services. The treasury section of Financial Services and the Treasury Bureau advises how much room there is within trend growth rates to increase recurrent public expenditure.

A committee chaired by the chief secretary then conducts the resource allocation exercise and puts forward proposals to the chief executive. A similar exercise takes place for capital projects.

Between then and the budget announcement, usually in late February or early March, the financial secretary considers revenue ideas – such as whether to cut taxes.

On the revenue side, I don’t think there is going to be scope for big reductions. There is more likely to be a hard look at raising fees and charges wherever possible. Postal charges look a prime target as the trading fund looks to still be in deficit, and the subsidy on water charges could be trimmed, with firm application of the “user pays” principle everywhere else.

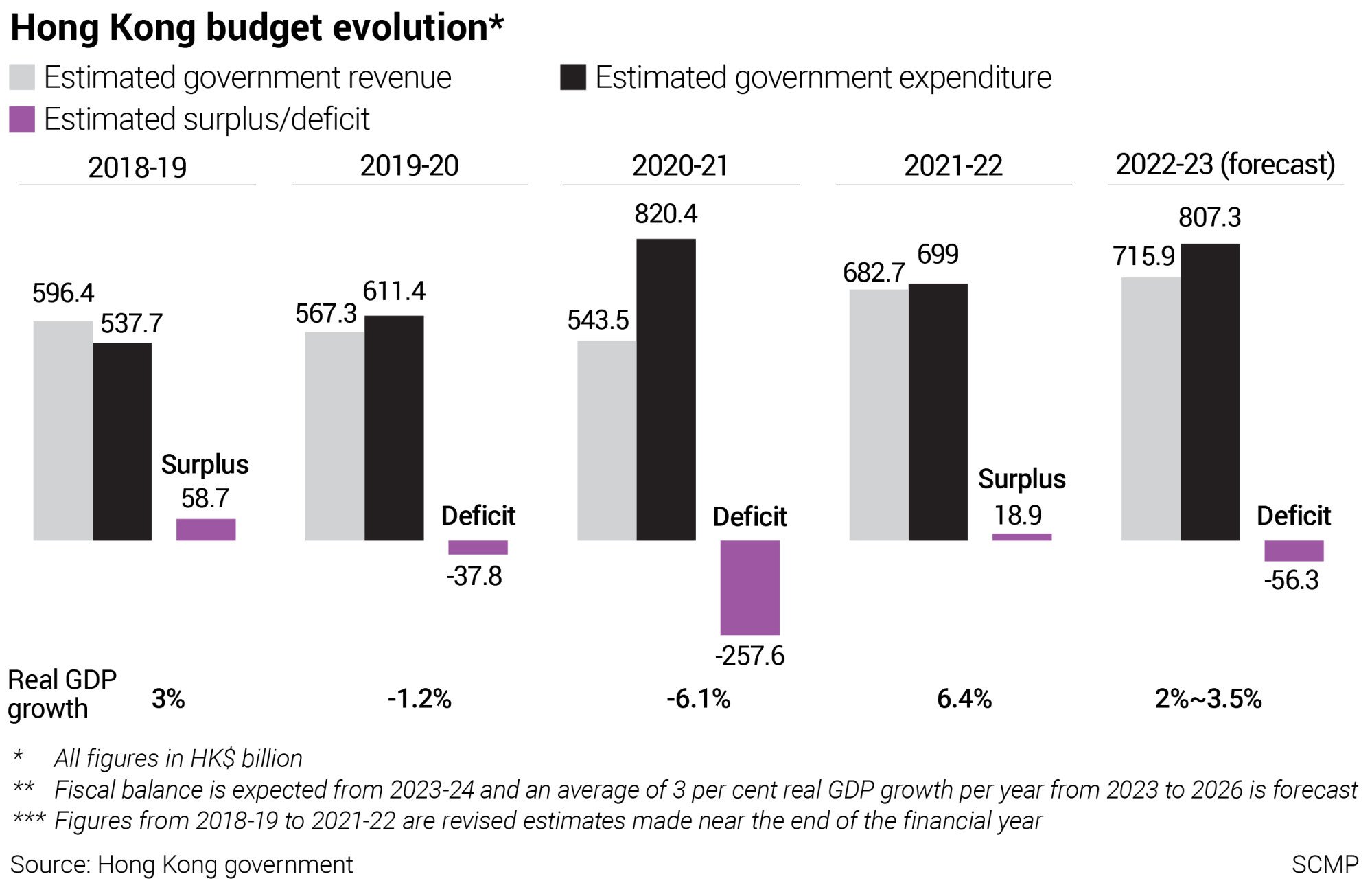

For April to July, the first four months of the current financial year, the government reported expenditure of HK$243.4 billion against revenues of HK$99.7 billion. The HK$143.7 billion deficit is reduced in cash flow terms by proceeds of HK$46.6 billion from green bond sales.

There is nothing nefarious or sinister about spelling out bond proceeds. Accountants and other professionals will have no difficulty understanding the situation. But the public needs to understand that the proceeds of bond sales are not really income – they are loans to be repaid.

As of July 31, these debts totalled HK$168.2 billion, but were more than covered by fiscal reserves of HK$834.8 billion. Hong Kong has been very prudent over the years and has net assets, unlike most other governments, such as the United States, which has accumulated a national debt in excess of US$31 trillion.

While it is encouraging that there is still enthusiasm in the market for government paper, we have just about reached the safe limit of the interest rate we should be prepared to pay. Much higher and a government would be in third-world territory.

Chan right to remain cautious on Hong Kong property

Chan right to remain cautious on Hong Kong property

Investors will require a plausible repayment plan, within a reasonable time frame, for the funds borrowed. After all, as the public well knows, but excitable politicians sometimes forget, there is no magic money tree that can be shaken to produce extra resources.

Mike Rowse is the CEO of Treloar Enterprises

[ad_2]

Source link